After nearly two years of booming, forecasters in recent months all said that the pace of housing prices increase would start to slow.

At present, with mortgage rates rising above 5%, some people even speculate if it is time for prices to fall.

How long can the strong housing market continue in this round of interest rate hikes by the Federal Reserve?

To find out how long house prices can rise, we can start by looking at what caused the current boom.

Housing demand expanded rapidly

In 2020, in the face of the huge changes brought about by the epidemic's impact on daily life, more and more people begin to pay attention to their living environment, hoping to change to a bigger house or move to areas far away from the city center.

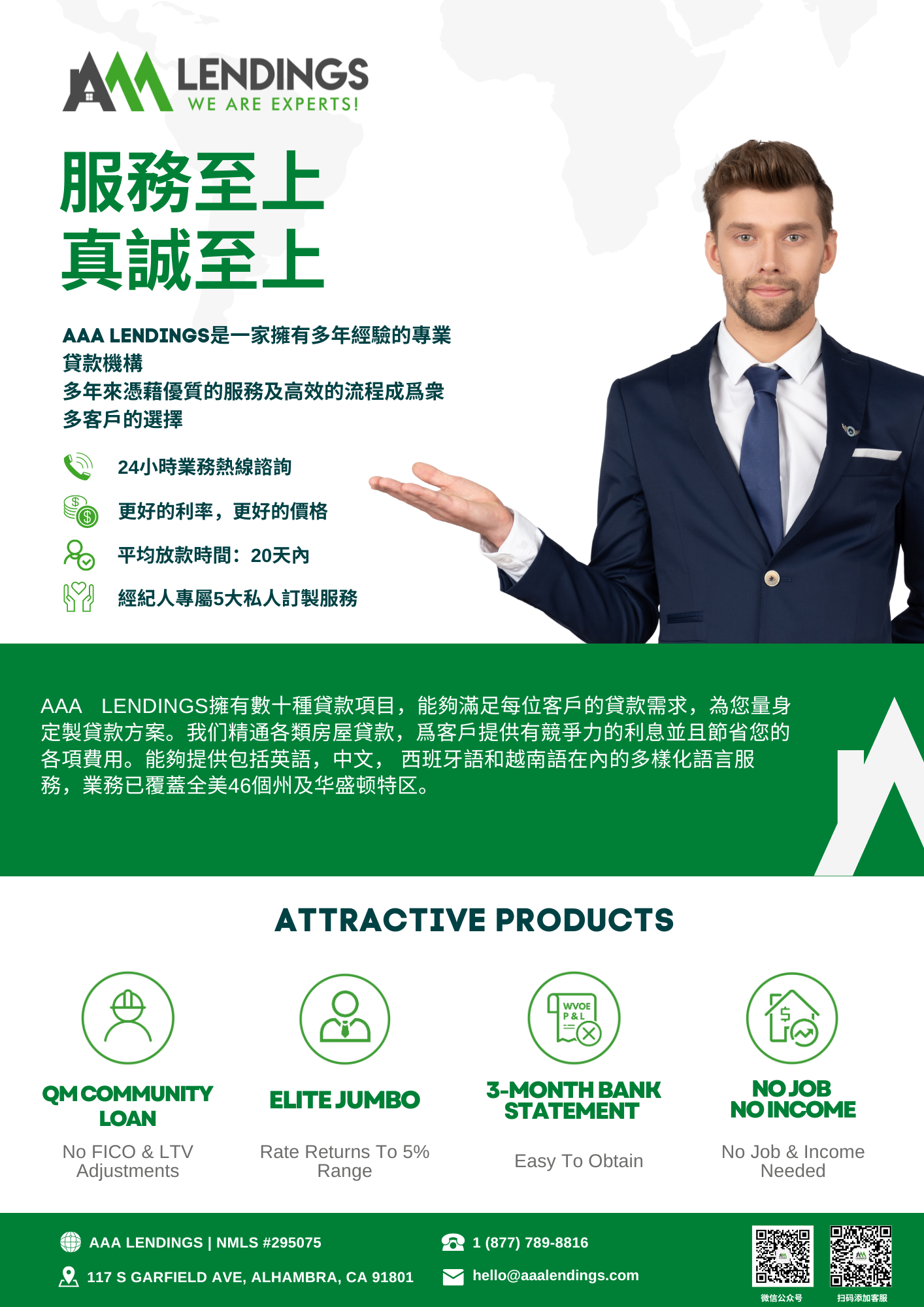

Millennials, the majority of home buyers, have also entered their home buying season, with nearly a third of young people saying the pandemic has prompted them to look for an apartment earlier. At the same time, the need to work from home has also boosted the need to buy or change houses.

In addition, the Federal Reserve's implementation of ultra-low benchmark interest rates brought about by the rapid decline in mortgage rates is a hot housing market to fill a hot oil.

In addition, the rapid decline in mortgage interest rates brought about by the ultra-low benchmark interest rate enforced by the Federal Reserve has propelled the popular housing market.

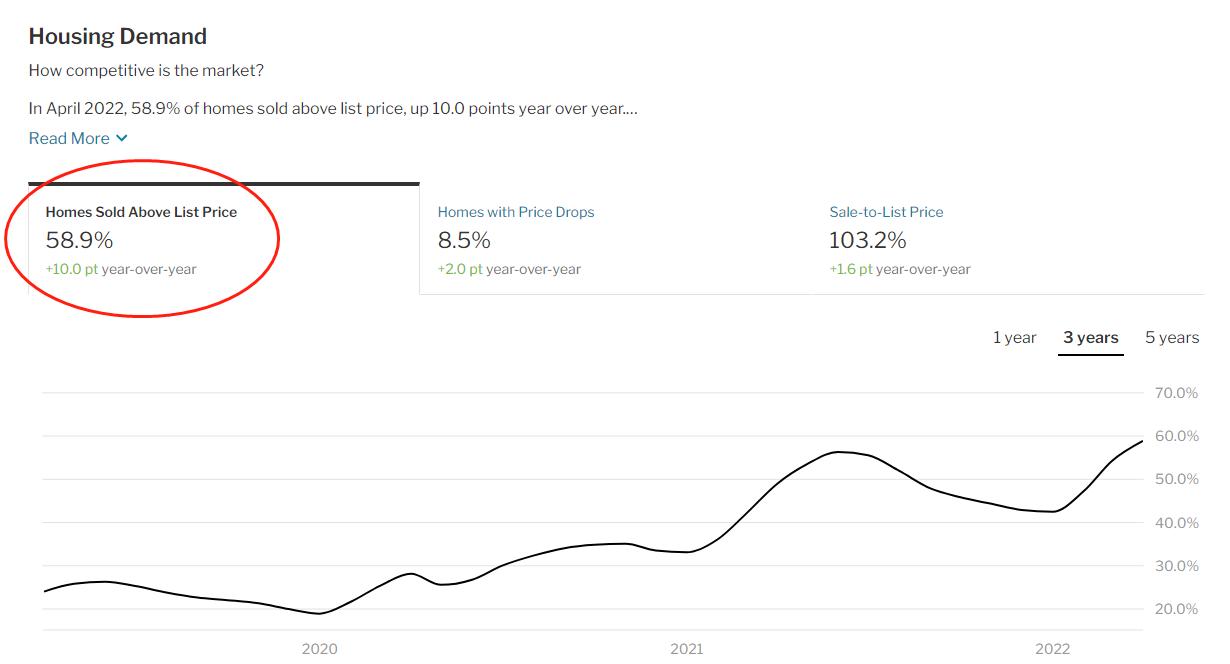

As potential buyers pile into the hot market, all sorts of house-grabbing wars occur.

Houses Are in extremely short supply

The pandemic has severely affected global supply chains, and loose monetary policy has also contributed to inflation and rising prices.

Construction costs have soared because of shortages of raw materials and disruptions to transportation. Houses that used to have ten workers working simultaneously now have three to five.

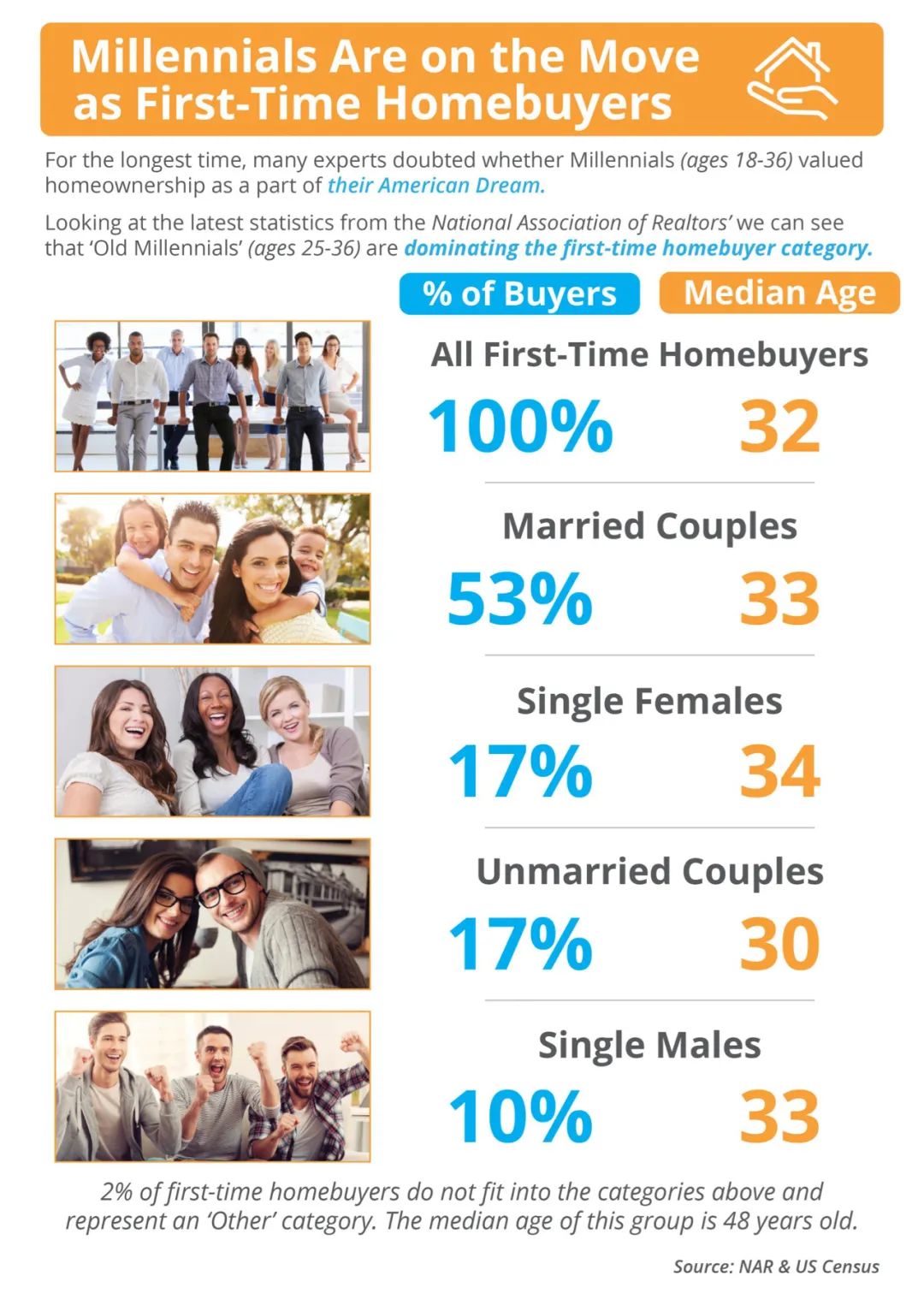

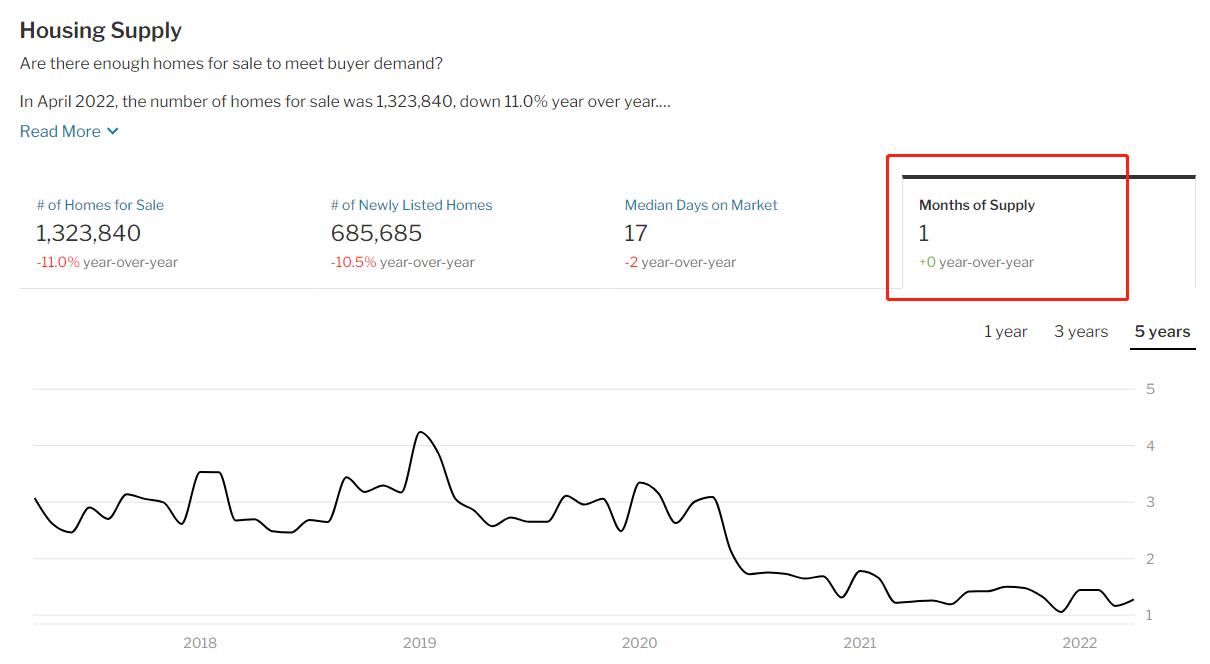

At the height of the pandemic, only one month's supply of homes available for sale (including new homes and second-hand houses) is only enough for the market to digest for one month, and the average sale time in many hot spots was no more than a week.

That is to say, in 2020-2021, you only have one week to complete the whole process of seeing and buying a house.

Even in this process, buyers have to endure the pick and choosing of sellers and developers: non-full buyers are not considered, non-markup are not considered, etc.. It is very common for a house to receive 20-30 purchase intentions.

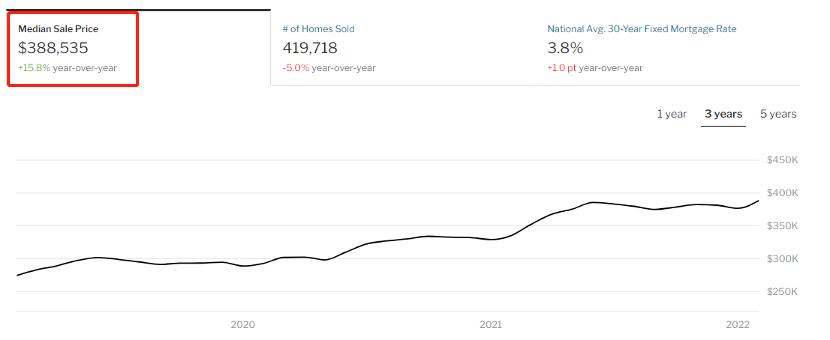

A variety of factors caused the extreme mismatch between supply and demand in the real estate market in the United States, which also led to a sharp rise in housing prices. The national housing price rose by 34.5% in just two years and 15.8% in 2021 alone.

Will house prices continue to rise?

The Federal Reserve has started to tighten monetary policy to combat inflation and rising prices, but with the implementation of the policy, mortgage interest rates have repeatedly broken new highs. More people are worried about whether rising interest rates will affect house prices.

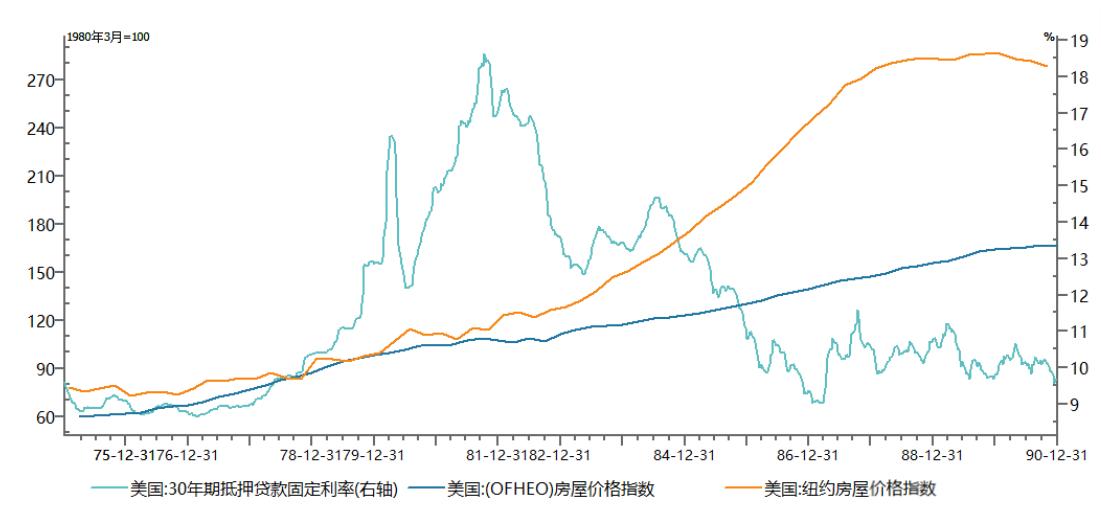

Historically, inflation is now equivalent to the levels in 1982, when mortgage rates were close to 13%. Mortgage interest rates were so high around 1982, did housing prices fall?

As we can see from the data below, housing prices rose slowly, but did not fall sharply.

As of the end of April, the number of homes for sale was 950,000 units, and the inventory was only about a month, which typically indicates a tight market when properties have less than five months to sell.

In addition, 58.9% of houses sell for more than the list price, a figure that is still trending, indicating that bidding wars are becoming more and more common, and the housing market is extremely competitive.

Supply and demand is often the decisive factor in the movement of housing prices; because of the extreme imbalance between supply and demand, housing prices are almost impossible to fall.

Indeed, Fannie Mae is still predicting that house prices will rise by 10.8% in 2022, while Zillow's forecast is more optimistic, believing that house prices are expected to increase by 14.9% this year.

The rapid rise of real estate interest rates will certainly have a negative impact on housing prices, but the specific performance should be a slowdown in the rise of housing prices. Housing prices may accelerate the rise after the End of the Federal Reserve interest rate hike.

In short, the fastest rise in housing prices may have passed, but the upward trend is unlikely to take a turn.