Rate hikes hit hard, Shrinkage hesitates

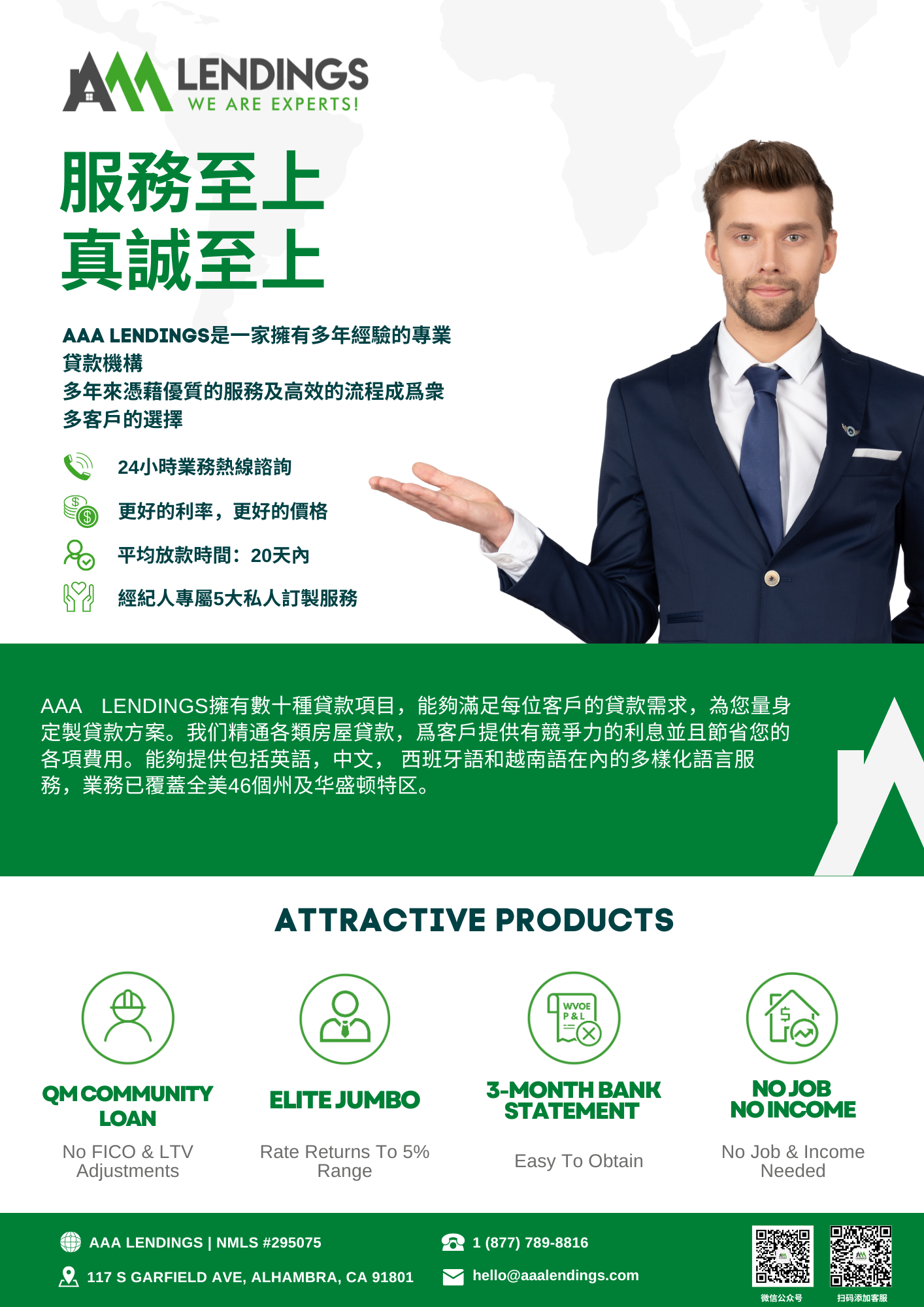

Three months ago, the Federal Reserve announced that shrinking the balance sheet was also on the agenda after starting the rate hike cycle.

According to the Fed's published plan, the size of this round of shrinkage will be the largest ever: $47.5 billion per month for three months starting in June, including $30 billion in Treasury bonds and $17.5 billion in MBS (mortgage-backed securities).

The market was more fearful of the unknown at the time of the shrinkage than the rate hike, after all, the impact on the market of taking such a radical approach to balance sheet contraction could not be underestimated.

But now three months have passed, and compared to the Fed's aggressive rate hikes throughout the year, the simultaneous push for shrinkage seems to have little presence, and earlier there were even many views that said that the Fed had not really started shrink the balance sheet, but instead had surreptitiously expanded the balance sheet to stabilize the equity and housing markets.

Yet is tapering really just a gimmick fabricated by the Fed? Indeed, the Fed is pushing ahead with tapering, just with far less aggressive intensity than everyone initially thought.

As expected by the Fed, the draw down from June to August is expected to be $142.5 billion, but so far only about $63.6 billion in assets have been drawn down.

Image source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

Less than half of the original plan for shrinkage - compared to the heavy hitters on the interest rate hikes, the Fed seems to be wishy-washy in terms of shrinkage.

Avoiding recession, slow pace of shrinkage in early stages

The low presence of the first round of shrinkage from June to August is largely due to the fact that the actual reduction in the size of Fed assets was far less than expected, and the market was clearly more affected by the Fed's aggressive rate hike policy.

In fact, in the first three months, the Fed's debt reduction in Treasuries is basically in line with the original plan, but the MBS holdings do not fall but rise, which led to many questions against the Fed: where did the said shrinkage go?

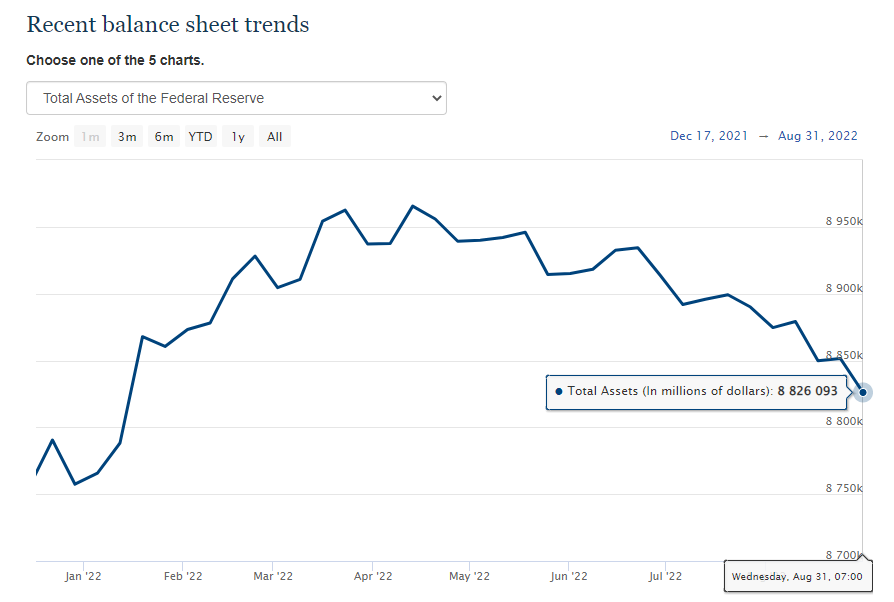

In fact, the MBS market had already seen a widespread sell-off before the Fed made its decision regarding tapering.

So far this year, the 30-year mortgage rate has almost doubled from the original 3%, which has caused a sharp increase in pressure on home-buyers, with some seeing their monthly mortgage expenses increase by more than 30%. The real estate market is rapidly cooling, and the decline in home sales is widening month by month.

Image credits.https://www.freddiemac.com/pmms

The Fed holds up to 32% of the $8.4 trillion MBS market, and as the largest single investor in the MBS market, opening the floodgates to debt sales in such a market environment could further push up mortgage rates and thus cause the real estate market to cool too quickly, which is a risk.

As a result, the Fed has significantly slowed the pace of tapering over the past three months, most likely with an eye toward the risk of recession.

The market can barely ignore the acceleration of shrinkage

As of September 1, the cap on U.S. debt and MBS shrinkage will be doubled and raised to $95 billion per month.

Many reports predicted that the market will start to feel the "chill" of tapering starting this month, the picture is so d√©j√Ý vu, but the market can hardly continue to "ignore" the doubling of the size of tapering after September.

According to the Fed's research, shrinkage would push up 10-year U.S. bond yields by about 60 basis points over the course of the year, equivalent to a total of two to three 25 basis point rate hikes.

With Powell reiterating his "hawkish rate hike" stance, although there are only three rate hikes remaining in September, November and December, but in the effect of the overlap of the double speed shrinkage and rate hikes, we expect the 10-year U.S. bond yield is likely to break through a new high of 3.5% later this year, mortgage rates are fearful of using in a new round of greater challenges.