Nonfarm payrolls data exceeded expectations again

On Friday, the nonfarm payroll report for September released, and it was a "strong" employment report by any measure.

Nonfarm payrolls increased by 263,000 in September, above market expectations of 255,000 and the unemployment rate unexpectedly fell to 3.5%, the lowest level in 50 years, and below market expectations of 3.7%.

Following the release of this report, U.S. stocks fell sharply and the yield on 10-year U.S. bonds even reached a new high, rising to over 3.9% at one point.

Good economic data once again turned into bad news for the market - the Fed had intended to reduce demand for labor, which would cool wage growth and ultimately lower inflation.

However, this report shows that the FedŌĆÖs rate hike was apparently "ineffective" and did not cool the labor market, which also reinforced the Fed's expectation of another 75 basis point rate hike in November.

In just a few months, from March to September, the Fed raised interest rates by a total of 300bp, but the labor market has been slow to cool.

Why is the labor market still strong after five consecutive rate hikes? The main reason is the lag in data.

The truth about "strong" numbers

There are two reasons for such strong employment data.

One is that people who are unwilling to work are not included in the calculation of the unemployment rate: According to the Department of Labor, nearly 2 million people were unable to work in September because of the pandemic - this population is not included in employment statistics.

Second, double counting: there are usually two ways of statistics for the number of people in the labor force, household surveys and establishment surveys.

The household survey is based on the number of persons, if a family has two people working, there are two employed persons; the establishment survey, on the other hand, is based on jobs, if one person works in two enterprises at the same time, there are two employed people.

The bottom line is that the nonfarm payroll data quotes the establishment survey data, and over the past six months, employment growth in the establishment survey has far outpaced the household survey.

This means that in the last six months, the number of people working more than one job at a time has increased, and some of those employed are ŌĆ£double counted.ŌĆØ

From the above, it is clear that the labor market behind the nonfarm payroll data may not be as hot as it appears.

Moreover, nonfarm payroll growth in September was the smallest increase since April ŌĆś21, and the small change in this data may be all the more noteworthy as job growth continues to slow.

The labor market has shown signs of weakness, but traditional key indicators do not reflect these phenomena in a timely manner due to a significant lag in data collection statistics.

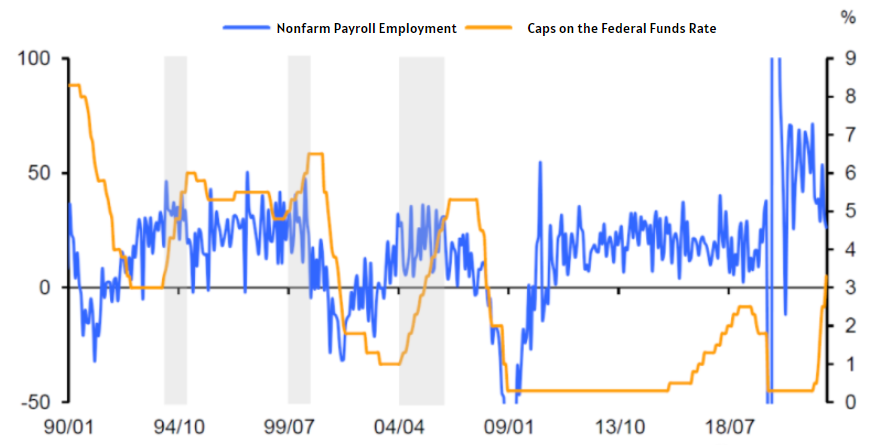

We can also take a look at the historical data. As you can see from the chart below, nonfarm payroll data has a ŌĆ£bluntedŌĆØ reaction to the FedŌĆÖs rate hike.

Data source: Bloomberg

Historically, several rate hikes have been able to dampen the upward trend in new nonfarm payrolls, but the reversal of the trend has almost always been staggered from the rate hike cycle.

This suggests that employment data also react with a lag to Fed rate hikes.

How nonfarm payrolls data will guide rate hikes

Raising rates too quickly could have a negative impact on the economy, and the Fed is well aware of that, but Powell cites the extremely low unemployment rate at every briefing as the most important evidence that the economy is not at risk of recession.

As we mentioned earlier, the FedŌĆÖs rate hike has had a lagged effect and has not yet been fully absorbed by the economy.

However, the slowdown in employment growth will also be gradual, with the labor market following the gradual cooling of the economy, leading to a subsequent moderation in inflation.

At this point, the Fed is also likely to slow or even suspend the pace of interest rate hikes.

However, the Fed continues to pay the closest attention to the nonfarm payrolls report and the core PCE rate, and the September nonfarm payrolls trend continues to provide the basis for a 75bp rate hike in November.

Interest rates will inevitably rise again, and homebuyers in need of a loan should start early to avoid missing an opportune time to secure lower rates.