Powell: the end of the housing bubble

In 2005, former Federal Reserve Chairman Alan Greenspan told Congress, "A housing bubble in the United States is unlikely."

The fact is, however, that a housing bubble already existed and was nearing its peak when Greenspan delivered that message.

Fast forward to the present of 2022, and since we were still frightened of the last housing bubble, this time economists are not afraid to admit its existence.

On November 30, the worldŌĆÖs most influential economist, Federal Reserve Chairman Jerome Powell, admitted the existence of a housing bubble at an event, saying that the rise in U.S. housing prices during the epidemic meets the definition of a ŌĆ£housing bubble.ŌĆØ

"During the pandemic, people wanted to buy houses and moved out of the city to the suburbs because of the extremely low mortgage rates, and during that time, housing prices rose to unsustainable levels, so there was actually a housing bubble in the United States.ŌĆØ

In September, Powell said: the United States has officially entered a "difficult adjustment periodŌĆØ in the housing market, they will restore ŌĆ£balanceŌĆØ between supply and demand in the market.

And now that the real estate bubble is over, the process of "re-balancing" the market has begun.

Outlook for the housing market in 2023

In 2022, crazy inflation has fueled the FedŌĆÖs determination to reduce inflation.

With one rate hike after another, mortgage rates have risen at an unprecedented pace, increasing from 1% at the beginning of the year to 7%.

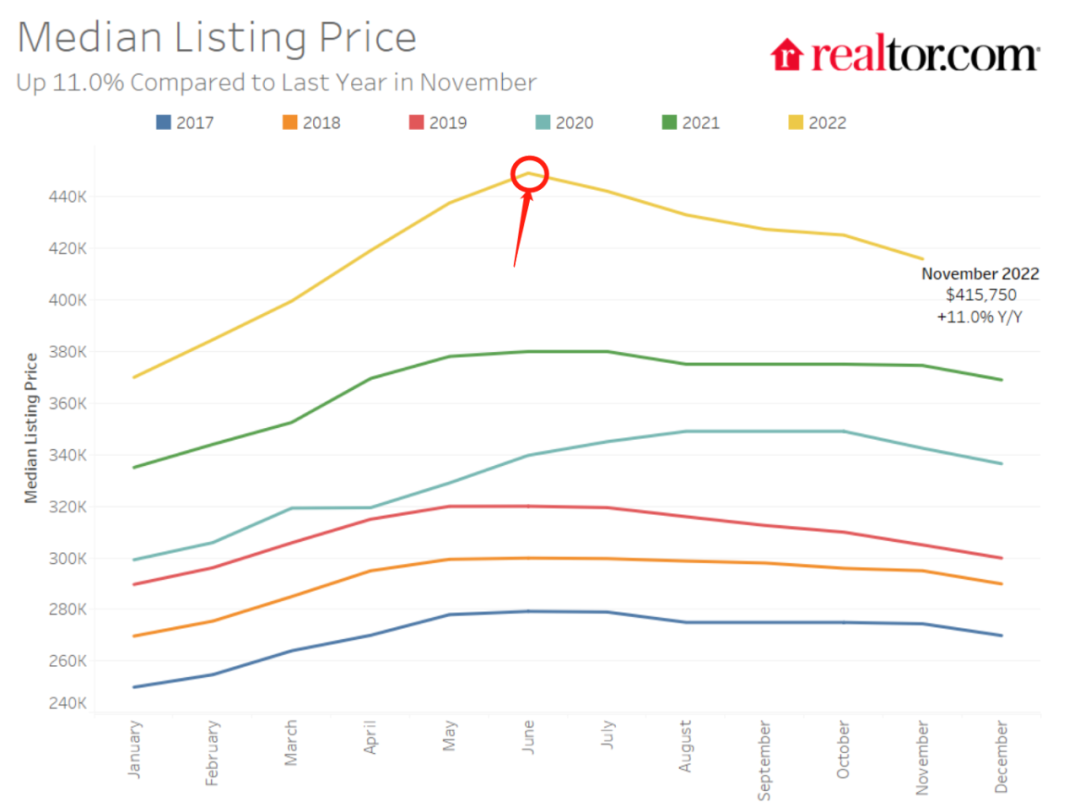

The national median home price has also been gradually declining since the second half of the year and was 7.9% below from its peak as of the end of November 2022.

(U.S. median listing price, January-November 2022; source: Realtor)

In less than a month, we are approaching the "period" of 2022 and some "question marks" for 2023: Will U.S. home prices continue to fall in 2023? When will the real estate market turn around?

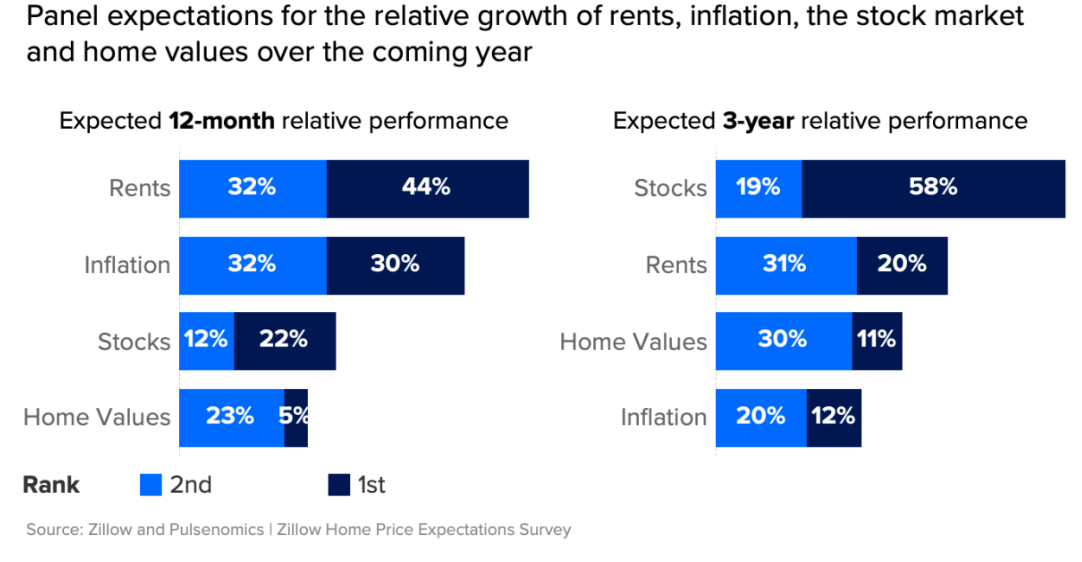

According to the Zillow and Realtor forecast, the average home price across the U.S. will continue to rise over the next 12 months.

In fact, most real estate economists predict that real estate prices will not fall significantly in 2023, but will continue to rise gently and slowly.

With high inflation, high mortgage rates, and slowing real estate transactions, why do most argue that home prices will not collapse in 2023?

Actually, the main judgment is based on the fact that inventory in the U.S. real estate market is still insufficient and the inventory of homes for sale is very low, which will help keep home prices stable.

Powell also acknowledged this in his speech last week - "None of these (housing adjustments) will create problems that will have a long-term impact, the number of homes under construction will be difficult to meet the public's needs, and the housing shortage appears likely to persist over the long term.ŌĆØ

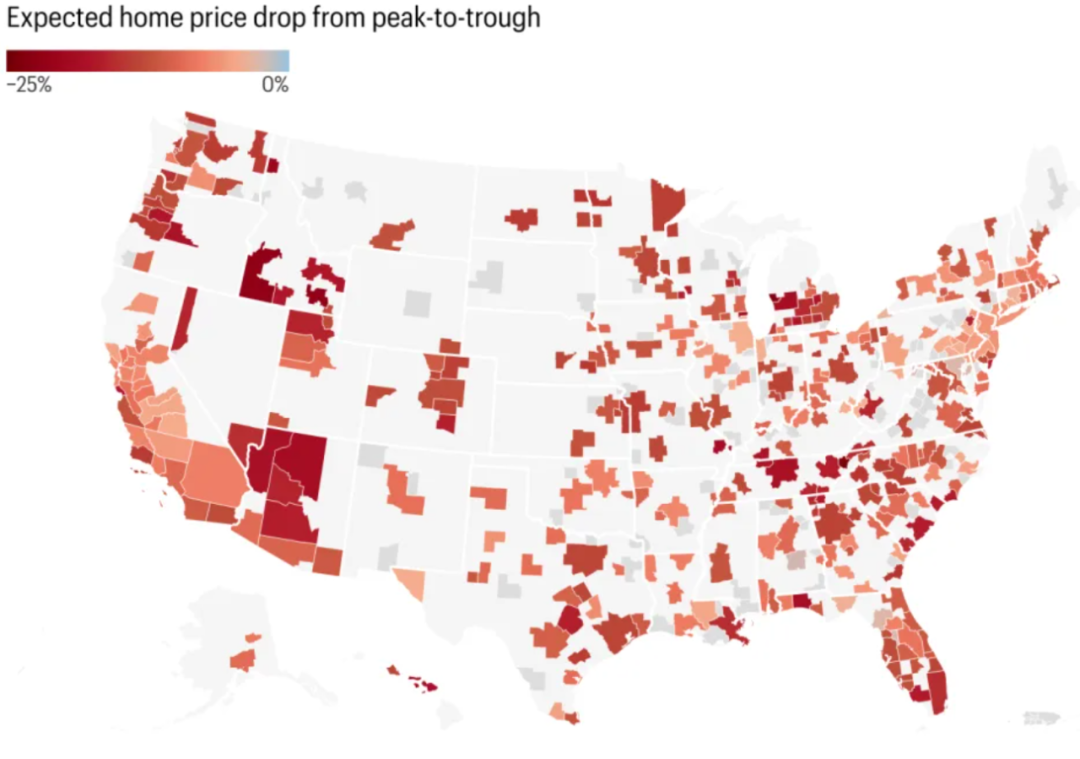

(Latest forecasts for 322 real estate market segments; source: Fortune)

Although the "extremely tight housing stockŌĆØ will stop the decline in housing prices, the different development of the real estate market may lead to a situation where housing prices increase in some areas and housing prices decrease in other areas. ŌĆ£

In particular, markets that were "highly overvalued" during the pandemic could see a steeper decline in prices.

Interest rates are peaking, when will the housing market turn around?

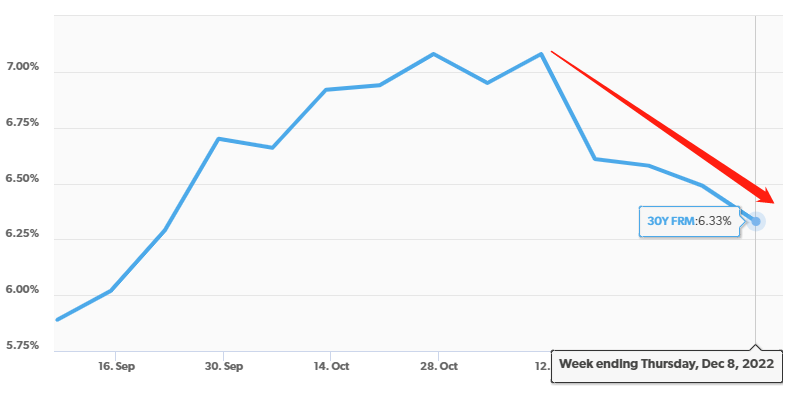

As of Dec. 8, the interest rate on 30-year mortgages had fallen from an annual high of 7.08% to 6.33%, after falling sharply for four consecutive weeks.

Source: Freddie Mac

Lisa, chief economist at Bright MLS, said, "This suggests that mortgage rates may have peaked." But she also cautioned that interest rates will continue to fluctuate due to economic uncertainty.

Most experts, however, believe that mortgage rates will fluctuate but remain in the 7% range and not break previous highs again.

In other words, mortgage rates have peaked! So when will the sluggish real estate market take a turn?

For now, high interest rates and tight supply will likely continue to hold back potential homebuyers, and weak demand could lead to a slight decline in home prices.

In the second half of 2023, however, the real estate market could see a rebound as interest rate hikes expire, mortgage rates fall, and potential homebuyer confidence gradually returns.

In short, "the Fed's interest rate hike" is one of the important factors disrupting the real estate market trend

When inflation peaks, the Fed will slow its rate hikes accordingly, and mortgage rates will gradually decline, which will have a positive impact on restoring confidence and investor enthusiasm for the housing market.