Many might have encountered this: you've just submitted a loan application to the bank, and your phone starts ringing incessantly before you can even catch your breath. Upon checking, it's all promotional messages from various loan or insurance companies, even if you've never transacted with them. This is because your information might have been turned into "Credit Trigger Leads", a common phenomenon of information leakage nowadays.

01 The Secret Information Black Market

According to the ITRC's 2022 data breach report, a total of 1,802 data breaches were reported last year. Alarmingly, the number of Americans affected by these breaches increased by about 40% from the previous year, reaching 422.1 million.

"Credit Trigger Leads" have become a widespread societal issue, affecting millions annually. Moreover, this data might be used for malicious purposes, such as scams or identity theft. The flood of unsolicited calls and messages can be not only bothersome but might also cause you to miss crucial calls or messages.

This trend has intensified in recent years. With the evolution of big data and AI, third-party companies can pinpoint potential customers more accurately. Thus, safeguarding against the "Credit Trigger Leads" phenomenon and protecting personal data has become an urgent matter.

02 Who's to Blame?

Before diving deep into how to guard against "Credit Trigger Leads", it's essential to understand its origins. Typically, there are two primary sources of this information leakage:

The "Side Effects" of Credit Applications: When you fill out a credit application, you might think you're only communicating with one financial institution. However, it might not be that simple. Your data might be treated as a "data commodity", shared or sold to other entities. These entities might be unfamiliar to you, but they can use your data to market their products or services.

The "Additional Services" of Credit Reporting Agencies: Companies like Equifax, Experian, and TransUnion, whose primary role is to collect and compile your credit information, might sometimes exploit this data to "customize" credit or insurance offers for you without your consent, known as "firm offers".

It's worth noting that it's not entirely the fault of credit companies or credit reporting agencies. Many banks and lending institutions have stringent privacy policies aimed at protecting your data. However, with the advancement of information technology, the dissemination of personal data has become more intricate, increasing the risk of breaches.

Moreover, other factors might contribute to the Credit Trigger Leads phenomenon. For instance, your data might be exposed online, like visiting insecure websites, or obtained by malicious third parties, leading to potential data breaches.

03 What Can I Do?

As consumers, how should we address and prevent information breaches?

Register on the National Do Not Call Registry: You can register your phone number on donotcall.gov. This way, your number will be added to a list, preventing you from receiving unsolicited calls. Note that adding your number to the list might take up to 24 hours, and removing it from existing lists might take up to 31 days.

Utilize the OptOutPrescreen Website: www.optoutprescreen.com is the official site of the consumer credit reporting industry, handling requests from consumers to accept or decline firm offers. You can choose to pt-out for five years or opt out permanently. You can also opt back in if you've previously opted out and wish to receive offers again.

Protect Personal Information: Online, avoid entering your details on insecure sites. Additionally, consider using security software like VPNs and firewalls to safeguard your data.

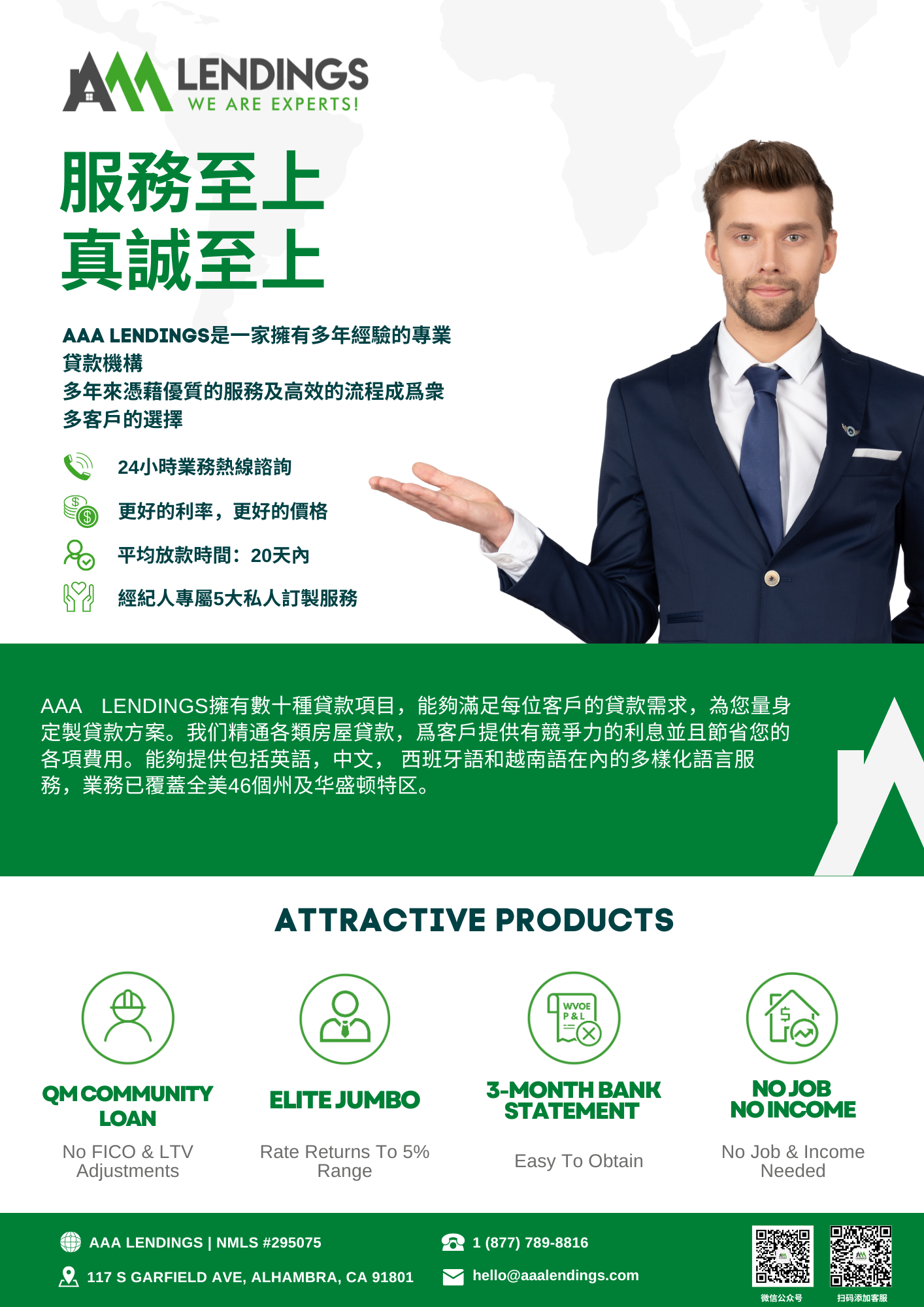

Choose Established and Reliable Credit Companies: Opt for credit companies with over 10 years of history and comprehensive services. Such companies often have better post-sale services and expertise to assist troubled clients, ensuring peace of mind. AAA LENDINGS, specializing in loans for the Chinese community in the US, has been in operation for over 15 years and is a trustworthy choice.