The Dream For All Shared Appreciation Loan (DFA Loan)'s goal is to help low- and moderate-income, first-generation Californian homebuyers achieve their dream of homeownership.

The program provides loans to help prospective homebuyers dramatically increase their down payment towards a home purchase, as well as help cover the closing costs associated with the loan.

What the homebuyers will need to pay?

1. The First Mortgage Loan ŌĆō this is the larger loan that finances most of the home purchase, and your monthly payments will go towards paying principal and interest on this loan.

2. DFA Principal ŌĆō this is the amount being loaned to the borrower for down payment and closing cost assistance. You will need to repay it when the DFA Loan becomes due and payable.

3. DFA Shared Appreciation Amount ŌĆō this is a portion of the increase in the home's value that will be paid to the lender (in this case, CalHFA), in addition to the DFA Principal, when the DFA Loan becomes due and payable.

What is the benefit?

1. If borrowers have steady employment, and can afford a monthly mortgage payment, this loan may help them get over the hurdle of coming up with a down payment.

2. Larger down payments can help lower the interest rate on the first mortgage loan and reduce the principal amount borrowed, both of which lower the monthly mortgage payments.3. A 20% down payment, in many cases, eliminates the requirement to purchase private mortgage insurance (PMI), saving thousands of dollars and making the monthly mortgage payments even more affordable.

What does the Shared Appreciation Note require?

1. Repayment of the total amount of funds advanced (DFA Principal) to assist with down payment and closing costs, and

2. Payment of a stated percentage share of the home's appreciated value (Shared Appreciation Amount) when a "maturity event" occurs.

What is a "maturity event"?

A "maturity event" is a specific circumstance or event that triggers repayment of a loan. Maturity events for a DFA Loan could include (but are not limited to) the following events:

- Sale or transfer of the property.

- Paying the first mortgage loan in full.

- Full repayment of the original down payment assistance amount (the "DFA Principal").

- In certain cases, refinance of the first mortgage.

How to calculate the Share Appreciation?

The calculation of the shared appreciation percentage will depend on whether a borrower is "low-income" or "moderate-income".

Low-income borrowers are those homebuyers earning less than 80% of the Area Median Income.For a low-income borrower, if the DFA Principal borrowed was 20% of the sales price, then the amount of appreciation owed would be 15% of the increased value of the home. This represents 75% of the percentage borrowed.If a low-income borrower takes out a DFA Loan for 20% of the homeŌĆÖs sales price or appraised value, whichever is less, they will owe the lender 15% (0.75 times 20%) of any increase in the home's value (appreciation) when a maturity event occurs. If they take out a DFA Loan for 16% of the home's sales price, they will owe the lender 12% of any increase in the home's value (appreciation) when a maturity event occurs.Moderate-income borrowers are homebuyers earning between 80% of the Area Median Income and 120% Area Median Income, based on CalHFA's income limits. For these "moderate-income borrowers", the DFA Loan will lend up to $150,000 or 20% of the sales price or appraised value, whichever is less, towards the down payment and closing costs and will share in a proportionate percentage of the appreciation of the home. In other words, if the DFA Principal borrowed was 20% of the sales price, then the amount of appreciation owed would be 20% of the increased value of the home.If a moderate-income borrower takes out a DFA Loan for 20% of the home's sales price or appraised value, whichever is less, they will owe the lender 20% of any increase in the home's value (appreciation) when a maturity event occurs. If they take out a DFA Loan for 16% of the home's sales price, they will owe the lender 16% of any increase in the home's value (appreciation) when a maturity event occurs.It can be a little confusing, so there are examples below to show how it works.

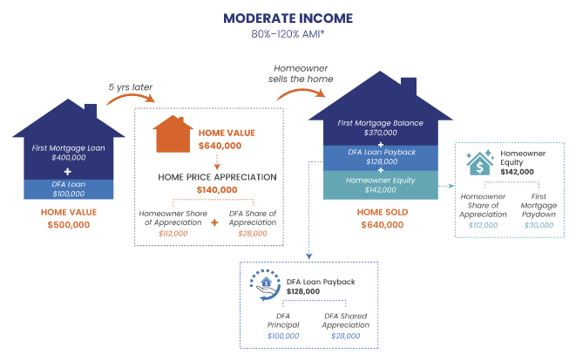

01 Example 1 - Moderate-income Maria

In our first example, Maria, a moderate-income borrower, purchases a home for $500,000 and takes out a 20% DFA Principal loan for $100,000. Five years later, the home value has increased to $640,000 and a maturity event occurs (like the home is sold).

The appreciation is the difference between $640,000 and the original sales price of $500,000, which is $140,000.Because the DFA Principal was for 20% of the home's original sales price or appraised value, whichever was less, and Maria is a moderate-income borrower, Maria will owe the lender 20% of the appreciation amount, which is $28,000 ($140,000 times 0.20).Ultimately, Maria would need to repay the original DFA Principal of $100,000, plus the Shared Appreciation Amount of $28,000, for a total of $128,000.Maria keeps the remaining 80% of the home's appreciation, or $112,000.

Note: In the above example, at maturity, Maria must pay the total amount due to the lender of $128,000 in one lump sum. Maria could use her savings, other cash on hand or proceeds of the sale to pay this amount.

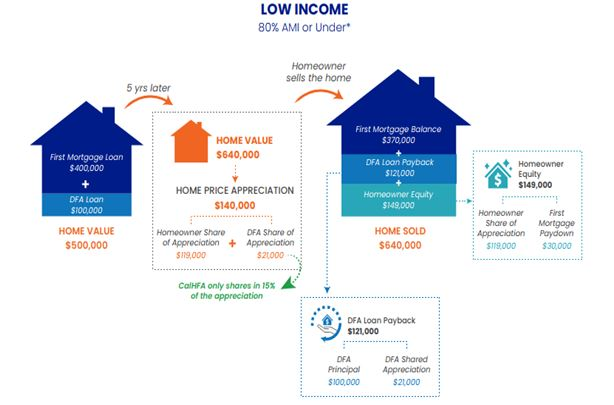

02 Example 2 - Low-Income Larry

The next example shows the calculation of the Shared Appreciation Amount for low-income borrowers. This is intended to accelerate the wealth-generating benefits of homeownership for low-income borrowers by allowing them to keep a larger share of the appreciated value of their home. (See "low-income borrower" section above for the difference in calculation amounts).

In this example, Larry, a low-income borrower, purchases a home for $500,000 and takes out a 20% DFA Principal loan for $100,000. Five years later, the home value has increased to $640,000 and a maturity event occurs (like the home is sold).The appreciation is still the difference between $640,000 and the original sales price of $500,000, which is $140,000. However, although the DFA Principal loan was for 20% of the home's sales price, Larry is a low-income borrower and only owes the lender 15% of the appreciation, which is $21,000 ($140,000 times 0.15).Ultimately, Larry would need to repay the original DFA Principal of $100,000, plus the Shared Appreciation Amount of $21,000, for a total of $121,000.Larry keeps the remaining 85% of the appreciation or $119,000.

Note: In the above example, at maturity, Larry must pay the total amount due to the lender $121,000 in one lump sum. Larry could use his savings, other cash on hand or proceeds of the sale to pay this amount.

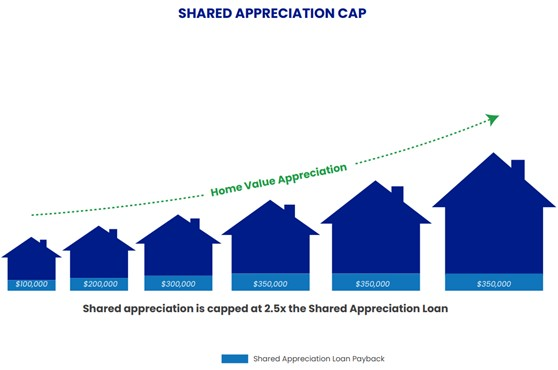

03 Example 3 ŌĆō Cap on Shared Amount Carlos

There is a cap on the amount of appreciation a borrower must pay of 2.5 times the DFA Principal. This means the maximum amount of appreciation the homebuyer would pay the lender cannot be more than 2.5 times the original DFA Principal amount.

If you perform the calculation as we did for Maria, the shared appreciation due would be $260,000 ($1,300,000 times 0.20). However, since there is a cap on the shared appreciation amount at 2.5 times the original DFA Principal amount, the maximum shared appreciation payment would be $250,000 ($100,000 times 2.5).When you add the original DFA Principal of $100,000 to the appreciation due, the total DFA repayment amount would be $350,000 ($100,000 plus $250,000).Carlos keeps the remaining appreciation amount of $1,050,000, in this example.

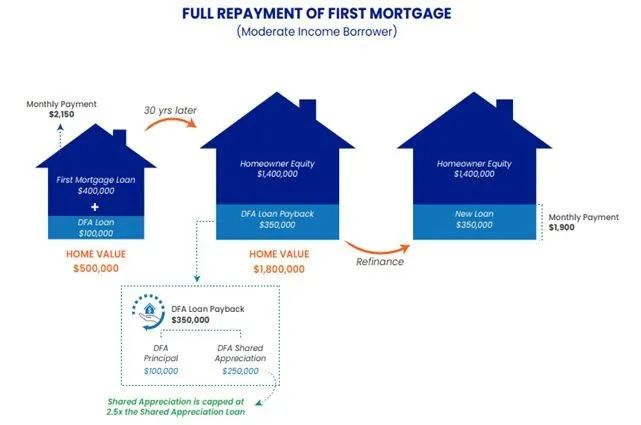

04 Example 4 ŌĆō End of First Mortgage Term Edward

The next example shows what happens if Edward, a moderate-income borrower with a DFA Loan stays in his home until he makes the final payment on the first mortgage loan.

Like the prior example, Edward purchases a home for $500,000 with a $100,000 DFA Principal loan. Edward and his family remain in the home for 30 years, ultimately paying off the first mortgage. Paying off the first mortgage is a maturity event that triggers repayment of the DFA Loan in its entirety.While his home has appreciated to $1,800,000 over the course of 30 years, the cap on shared appreciation means Edward only owes $350,000 to repay their DFA Loan.Edward could pay the lender with cash on hand and/or savings, but he may not have that much cash or savings available for repayment. In this case, Edward can refinance the home and take out enough cash, $350,000, from the home's equity to pay the lender.Edward would then have a new mortgage loan and loan terms. In this example, Edward still has equity in the home of approximately $1.4 million.

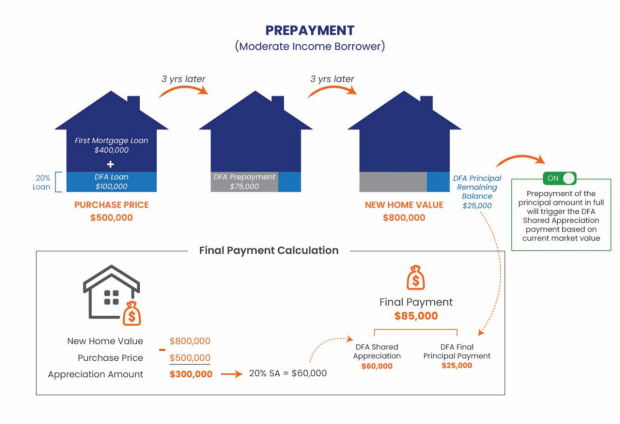

05 Example 5 ŌĆō Prepayment of DFA Loan Peng

This example demonstrates how prepaying the original DFA Principal loan will affect the payoff. Like the first example, the sales price of the property is $500,000, so the DFA Principal will be 20% or $100,000.

Three years after purchasing the home, Peng, a moderate-income borrower, makes a prepayment on the DFA Principal in the amount of $75,000, which leaves a DFA Principal balance of $25,000. This prepayment amount reduces the DFA Principal payment only; it does not change the Shared Appreciation Amount.In this example, Peng sells the home three years later for $800,000, which is $300,000 more than the original home sales price. Peng then owes the remaining principal balance on their loan, $25,000, plus the 20% share of the appreciation in the homeŌĆÖs value, $60,000 ($300,000 times 0.20), for a total DFA Loan repayment of $85,000.Additionally noted in this example, if Peng were to prepay the entire DFA Principal, that would be a maturity event that will trigger a payment of the Shared Appreciation Amount as well.

Note: In the above example, at maturity, the homeowner must pay the total amount due to the lender, $85,000, in one lump sum. Peng could use savings, other cash on hand or proceeds of the sale to pay this amount.

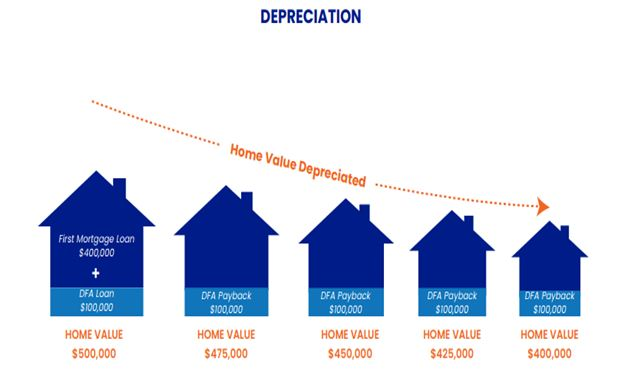

06 Example 6 ŌĆō Decrease in Home Value Deena

All the prior examples assume the home value increases. Sometimes, however, home prices go down. So, what happens if a home with a DFA Loan loses value?

In this case, there would be no appreciation in the value of the home, so there would be no Shared Appreciation Amount due. However, the original amount of the DFA Principal is still due upon any maturity event.If Deena's home loses value but she needs to sell due to unforeseen circumstances, she will still owe the balance on the first mortgage and the DFA Principal.Homeowners considering a DFA Loan should talk to their lenders about what options they will have if they must sell their home and its value has declined.

Can the inmprovements fee be deducted from the share appreciation?

It's common for homeowners to make improvements to the house in the years following the purchase, like remodeling or upgrading finishes in the home. These improvements are not deducted from the appreciation share due to the lender.