Introduction

This topic contains information about higher-priced mortgage loans, including:

¬ЈDefinition of the HPML

¬ЈRequirements for HPML loan

Definition of the HPML

In general, a higher-priced mortgage loan is one with an annual percentage rate, or APR, which is higher than a benchmark rate called the average prime offer rate.

The Average Prime Offer Rate (APOR) is an annual percentage rate based on average interest rates, fees, and other terms on mortgages being offered to highly qualified borrowers.

Your mortgage will be considered a higher-priced mortgage loan if the APR is a certain percentage higher than the APOR and depends on what types of loans you have:

¬ЈFirst-lien mortgages: APR is 1.5 percentage points or more higher than the APOR.

¬ЈJumbo Loan: APR is 2.5 percentage points or more higher than the APOR.

¬ЈSubordinate-lien mortgages (2nd Lien): APR of this mortgage is 3.5 percentage points or more higher than the APOR

Requirements for the HPML Loan

A higher-priced mortgage loan will be more expensive than a mortgage with average terms. Therefore, your lender will have to take extra steps to make sure you can pay your loan back and wonвАЩt default. Your lender may have to:

¬ЈObtain a full interior appraisal from a licensed or certified appraiser.

¬ЈProvide a second appraisal of your home for free, if it is a вАЬflippedвАЭ home.

¬ЈIn many instances, maintain an escrow account for at least five years.

AAA LENDINGS, founded in 2002, is a well-established mortgage lender in Southern California. Over the years, we have maintained our leading position in Asian American community with professional and high-quality services. We are the expert to provide solution to the toughest scenarios, at the same time, provide customers with competitive interest rate and reduce the overall costs.

Choose us. We have a wide range of loans:

е£∞жШОпЉЪ

жЬђжЦЗзФ±AAA LENDINGSзЉЦиЊСжХізРЖпЉМйГ®еИЖзі†жЭРжХіеРИиЗ™дЇТиБФзљСпЉМжЬђжЦЗдЄНдї£и°®зљСзЂЩзЂЛеЬЇпЉМжЬ™зїПеЕБиЃЄдЄНеЊЧжУЕиЗ™иљђиљљгАВ

зЫЄеЕ≥жО®иНРпЉЪ

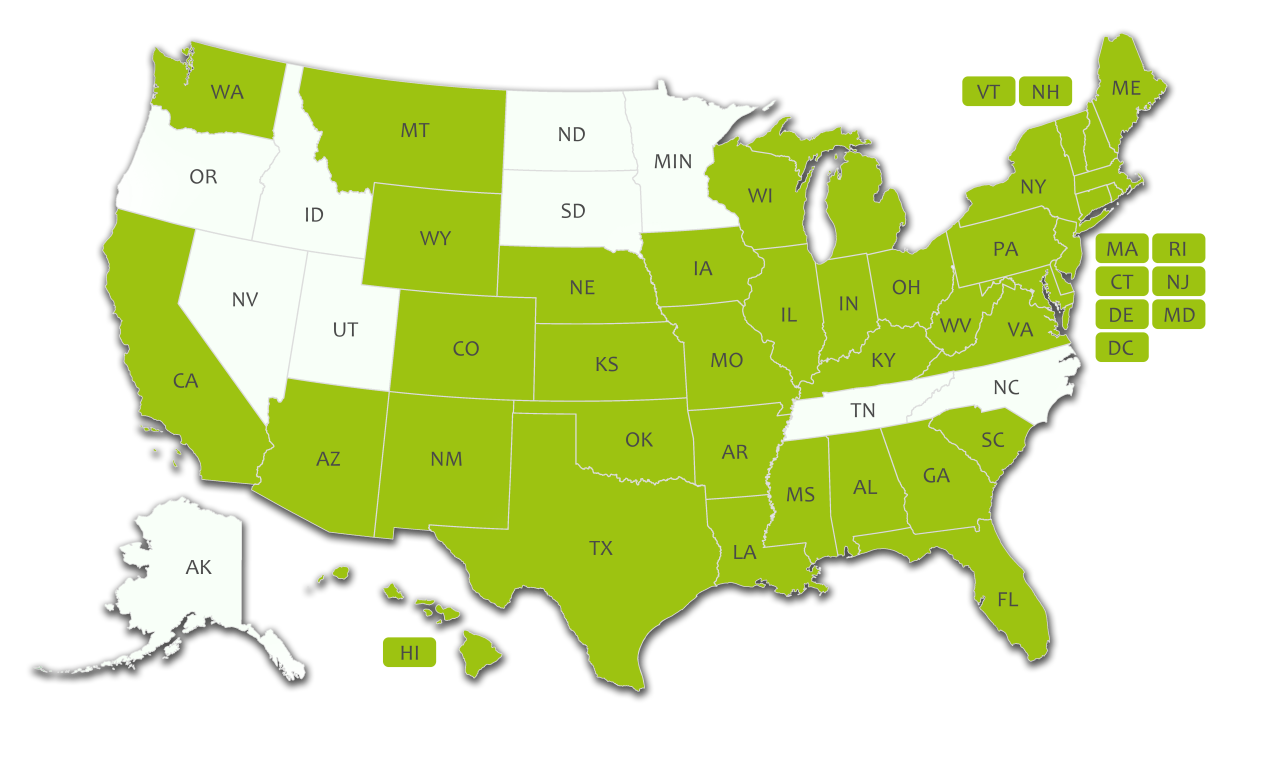

GOOD NEWS!! We Expanded 41 Additional States for Investment Property Loan

SPECIAL PROGRAM FOR INVESTMENT PROPERTY ONLY-DSCR

еИ©зОЗйАРжЧ•жФАйЂШпЉМиѓ•е¶ВдљХжХ≤еЃЪжВ®зЪДиіЈжђЊйУґи°МпЉЯ