I was shocked to hear my old friend Tom talk about his real estate roller-coaster investment experience.

Tom started his career life in 2011. Unlike me, he started investing real estate since 2014. Except for his daily expenses, the rest of his reserves are invested in the real estate market.

On top of that, he even borrowed money from different lenders to buy houses. By the year of 2017, there were probably five or six investment properties in his hands.

Tom revealed the details of his annual investment income comes about two sources:

1. Cash flow of the rental properties.

2. Sold the properties held for one or two years, the returns are nearly reach up to 10% or sometimes even higher.

Such highly-rewarding investment career leads him resigned the job in March 2017 and became a full-time landlord after that.

Up to now, his annual gross rent income can be up to a hundred thousand dollars; in addition, as the house price rise, the value of the investment property increases significantly.

In fact, the real estate market has been aвАЬhot-worthy investmentвАЭprogram for global investors since the 1990s. Investors investing in real estate, not only to fight the inflation, save taxes, but also to use leverage effectively. Invest in the property market can help investors get stable income in a few years, it also can help investors achieve assets prosperity in the future.

With the stable rental income from the investment properties and the property itself value grow over time. Real estate has been seen as the best hedge against the inflation.

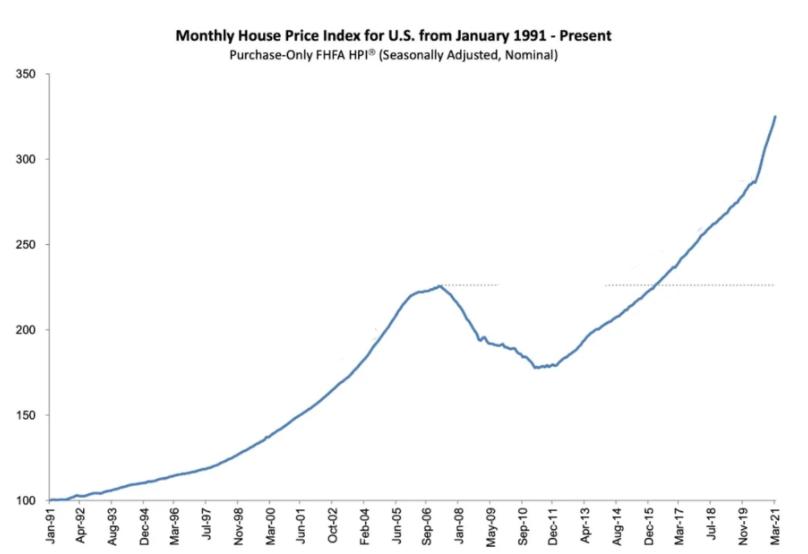

According to historical data, except for the subprime mortgage crisis in 2007, the price of real estate market have hardly ever fallen. From 1992 to 2021, property prices rose by an average of 4% per year, almost consistently higher than the annual rate of inflation over the same period.

Source from the Federal Housing Finance Agency.

Investors can get great returns by using limited about of money.

For example:

If an investor wants to buy stocks with sum $500,000, he has to put $500,000 in.

But if the investor purchases a $500,000 property, he might just need to put $200,000 in the market and wait for the house price to grow up to $500,000.

For example: to buy a $500,000 stock, you usually have to put $500,000 in. But if you buy a $500,000 property, you might just put in $200,000 and wait for the investment to grow to $500,000.

In addition, the rental market continues to experience an unprecedented boom, with a record 700,000 units rented from the first quarter of 2021 to the first quarter of 2022, more than double of the recent five-year average.

In general, the rent price will rise if the tenant wants to renew the lease. So the real estate income tends to grow faster in an inflationary environment.

Source from https://wallstreetcn.com/

The latest data from the Labor Department showed that the consumer price index rose 8.5% in July from a year earlier, still at a nearly four-decade high, and such high inflation is leading to devaluation of deposited assets.

If there is any way to invest in a context of high inflation, the answer must be borrowing more from banks. Wise investors must learn how to borrow more to invest.

In fact, when the rate of inflation is equal to your cost of borrowing, itвАЩs like borrowing money for free; if the inflation rate is higher than the cost of borrowing, then the banks and the government are paying extra money to you.

So how to borrow the max amount of money from the bank at a suitable interest rate within the economic capacity? The key is to investing in real estate market! Do you think purchasing a property with all cash will be a proper way to fight the inflation especially since inflation is running at 8% recently?

If you have $500,000 in cash and you use it to buy a $500,000 property, assuming that the property appreciated to $600,000 after 5 years, then the 5-year term rate of return will be 20% (Under ideal conditions) . However, the increase of $100,000 may not catch up with the inflation rate.

But if you borrow money from the bank, you can use $500,000 to buy two properties with financed 5 years later, you will get two properties with total value $1.2M. Then your 5-year term return can up to 140% {($1,200,000-$500,000)/$500,000=140%, Under ideal conditions and assuming the rental income from the house is greater than the debt expenditure}!

Above examples show that itвАЩs not the real estate you purchased can really help you resist inflation; itвАЩs the high-quality debt you financed can really helped you fight inflation and grow your wealth.

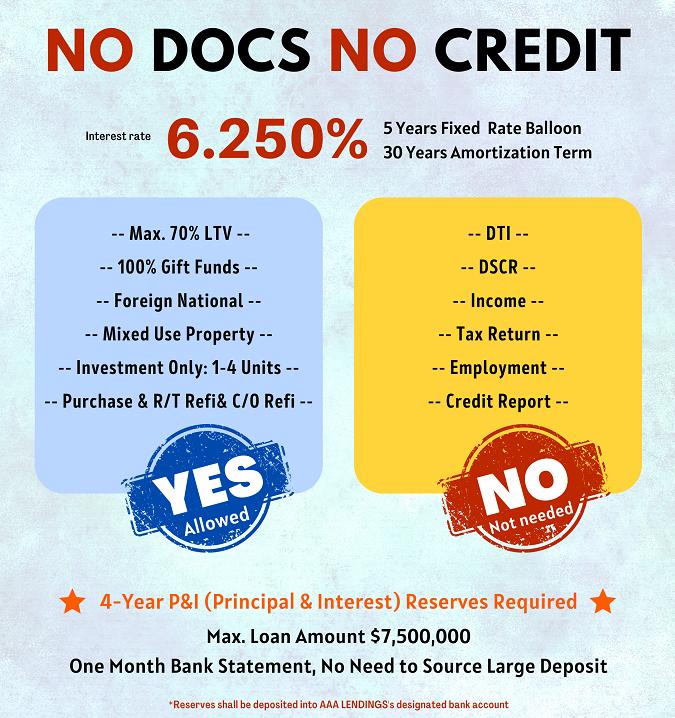

We do have a good news for all real estate investors, our new program: No Doc, No Credit! The interest rate is low to 6.25%!

Only 4 years P&I reserves needed! The uniquely simply loan process will help you beat inflation easily!

In short, knowing how to borrow money will help you make more money!