History of U.S. Banking

In 1838, the United States enacted the Free Banking Act, which allowed for the free development of the early financial sector.

At that time, anyone with $100,000 could open a bank.

The banking industry allowed mixed businesses, commercial banks could handle loan transactions, but were also involved in investment banking and insurance, meaning banks not only took deposits from depositors, but also took depositors' money to make risky investments.

Thus, the number of U.S. banks grew rapidly, lured by the relaxed entry requirements and the enormous benefits.

However, with the rapid development of the banking sector, the lack of uniform standards and supervision has led to chaos in the banking sector.

During the Great Depression of 1929, when banks recklessly used depositors' money for risky investments, the collapse of the U.S. stock market triggered a run on banks, and more than 9,000 banks failed within three years - a mixed operation that is considered a major factor in triggering the Great Depression.

In 1933, Congress enacted the Glass-Steagall Act, which prohibited mixed operations by banks and strictly separated the operations of investment banks and commercial banks, meaning that deposits taken by commercial banks could only be low-risk.

JP Morgan Bank as we know it also had to split into JP Morgan Bank and Morgan Stanley Investment Bank at that time.

At this point, the American banking sector entered a phase of separation.

During this period, the banking industry operated a relatively unified business, and both the scope of the business and the size of the business were constrained to some degree.

In December 1999, the Financial Services Modernization Act was passed in the U.S., eliminating the boundaries between banks, securities institutions and insurance institutions in terms of business scope, ending nearly 70 years of separation.

The "past life" of mortgages

Originally, mortgage loans were mainly Balloon Payment loans in a short or medium term.

However, these loans were very sensitive to changes in housing prices, and when the Great Depression began, housing prices continued to fall and banks faced large amounts of bad debt, creating a vicious cycle that resulted in residents losing their homes and a large number of banks going bankrupt.

After the crisis, in order to stimulate the economy and solve the housing problem of residents, the United States began to assist residents in obtaining mortgage loans in the form of government guarantees.

The Federal National Mortgage Association (FNMA or Fannie Mae) was established in 1938 primarily to purchase mortgages guaranteed by the Federal Housing Administration (FHA) and the Veterans Administration (VA) and began purchasing non-government guaranteed regular mortgages in 1972.

At that time, the mortgage market as a whole was still very dysfunctional, and against a background of segmentation, investment banks gradually discovered that through asset securitization, they could decompose a single residential mortgage loan with a large amount of money into a large number of bonds of smaller amounts, which greatly improved liquidity.

Therefore, in 1970, the government created the Federal Home Mortgage Corporation (FHLMC or Freddie Mac) to fully develop the secondary market for residential mortgages.

The creation of Freddie Mac directly contributed to the development of the secondary market for residential mortgages and gave the go-ahead for mortgage securitization.

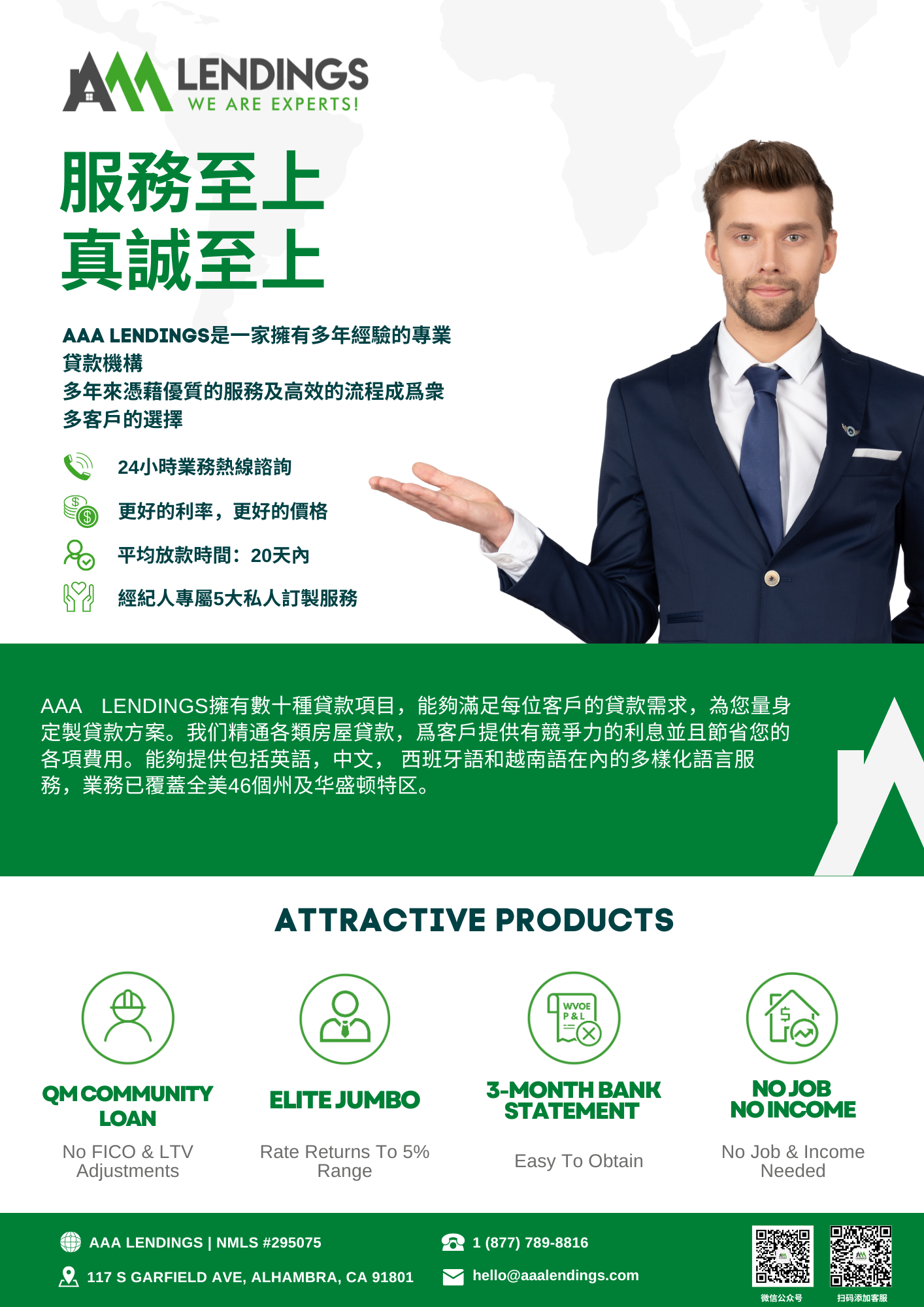

Difference between Mortgage Lender and Retail Bank

When a borrower is considering applying for a home loan, the two most common ways are to go directly to a bank (Retail Bank) or to a mortgage broker (Mortgage Lender).

The retail bank (commercial bank), on the other hand, is usually a mixed company that offers mortgages as well as financial services such as savings, credit cards, auto loans, and investments.

When a borrower approaches a particular bank, they will only have access to that bank's information and services, and the bank's services are often limited to the loan itself, making it difficult to fully integrate the intricacies of the relationship between the home and the loan.

While the retail bank's fees may be lower, the mortgage lender typically offers more professional service, faster response, and a broader selection of products for a wider audience.

Mortgage Lender can provide borrowers with comprehensive and professional credit counseling, help guests answer a variety of complex questions about loans and financing portfolios, and find the best fit for the borrower among dozens of products.

This also means that the lender’s position is more favorable to the borrowers, as they have more options and tangible benefits.

It can be said that finding a good mortgage lender and a good mortgage loan originator can save the borrower money, time, and get the best product information the first time.