Last week, the eyes of the world markets turned once again to the Federal Reserve - at the end of a two-day rate meeting, the Fed will announce its monetary policy decisions for December, along with its latest quarterly summary of economic projections (SEP) and dot plot.

Unsurprisingly, the Federal Reserve slowed its rate hike on Wednesday as expected, raising the federal funds rate by 50 basis points to 4.25%-4.5%.

Since March of this year, the Federal Reserve has raised rates by a total of 425 basis points, and this December rate hike capped off a year of tightening and was arguably the most important turning point in the current rate hike cycle.

And what significant signals did the Fed give for this year-end show of interest rates?

How will rates be raised next February?

With rate hikes slowing to 50 basis points this month, a new tension has emerged: Will the Fed "slam on the brakes" again?

At the interest rate meeting in early February next year, the Federal Reserve will raise rates by how much? Powell responded to this question.

First, Powell acknowledged that the effects of the previous sharp rate hike "are still lingering" and reiterated that the appropriate approach now is to reduce the rate hike; however, the next rate hike will be decided based on new data and financial and economic conditions at that time.

As you can see, the Fed has officially entered the second phase of slow-paced rate hikes, but subsequent rate hikes will still be determined by closely monitoring inflation data.

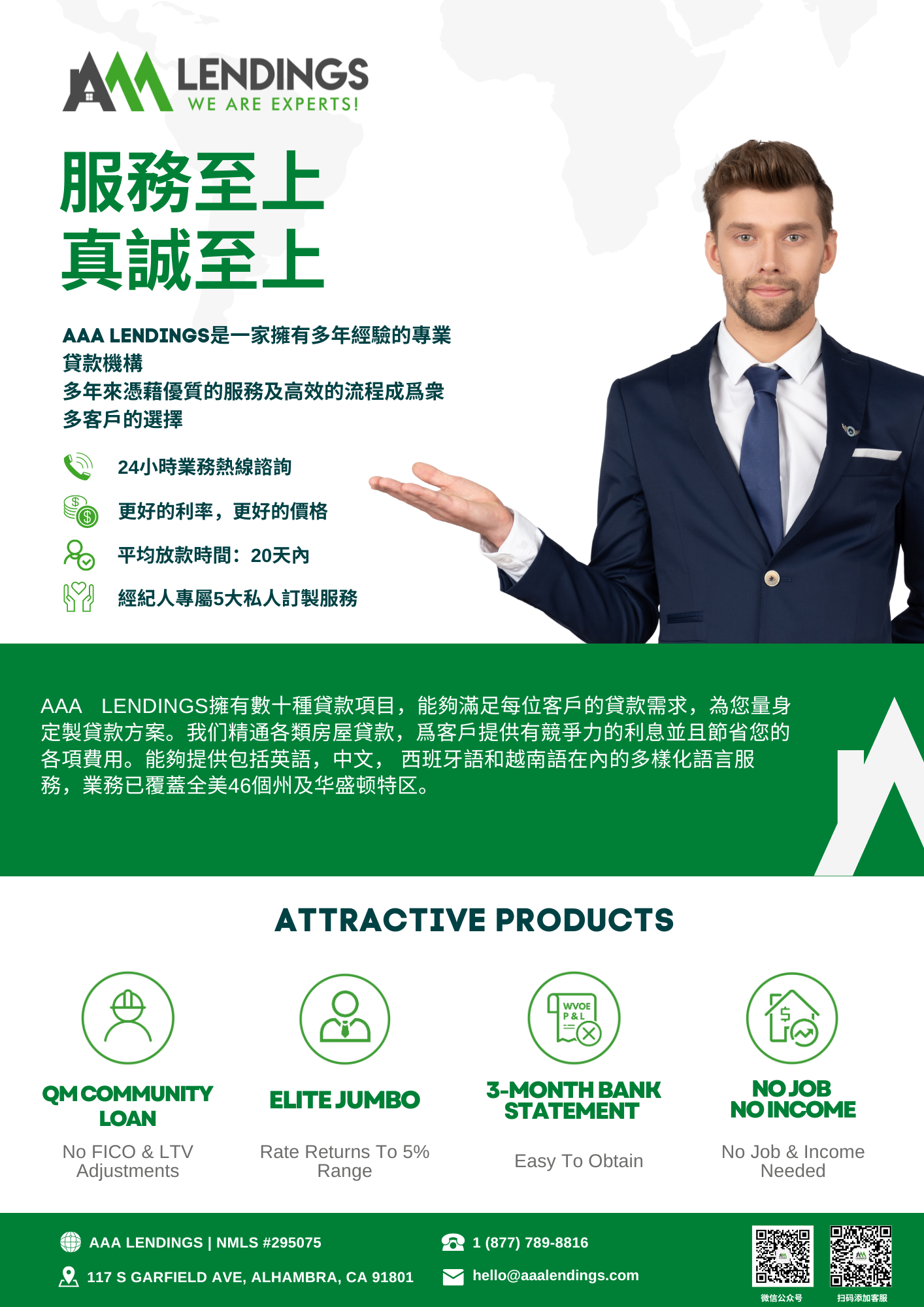

Image credit: CME FED Watch Tool

Given the unexpected slowdown from CPI in November, market expectations for the next 25 basis point rate hike have now risen to 75%.

What is the maximum interest rate for the current round of rate hikes?

The speed of rate hikes is currently no longer the most important issue in the Fed's deliberations; what matters is how high the final interest rate level needs to be.

We find the answer to this question in the dot plot of this note.

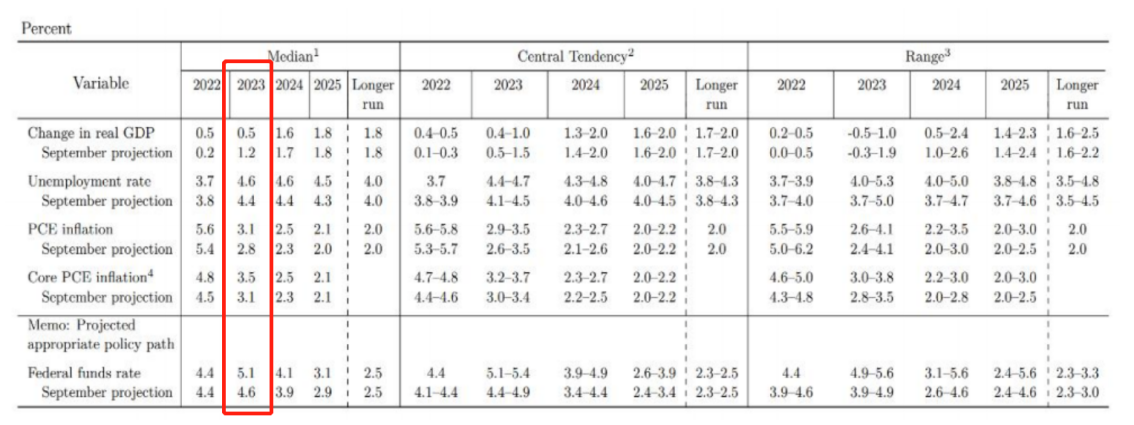

The dot-plot is published at the interest rate meeting at the end of each quarter. Compared to September, this time the Fed has raised its expectations for next year's policy rate.

The red-bordered area in the chart below is the widest range of Fed policymakersвАЩ expectations for next yearвАЩ s policy rate.

Image source: the Federal Reserve

Out of a total of 19 policymakers, 10 believe rates should be raised to between 5% and 5.25% next year.

This also means that a cumulative 75 basis points of rate increases are needed at subsequent meetings before rates can be suspended or lowered.

How does the Fed think inflation will peak?

The Labor Department reported last Tuesday that CPI increased 7.1% in November from a year earlier, a new low for the year, making five consecutive months of year-on-year CPI decline.

In that regard, Powell said: There has been a "welcome decline" in inflation over the past two months, but the Fed needs to see more evidence that inflation is falling; however, the Fed also expects inflation to fall sharply over the next year.

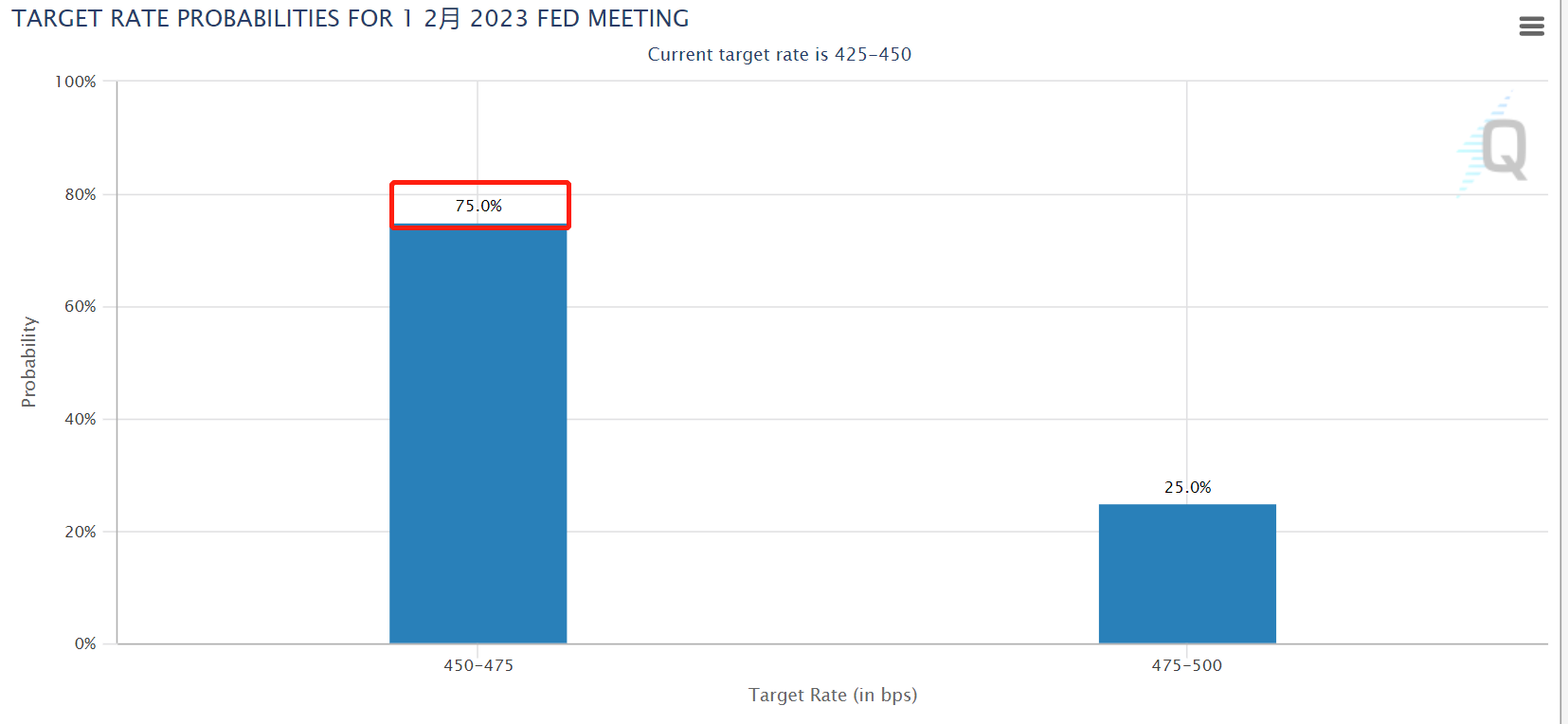

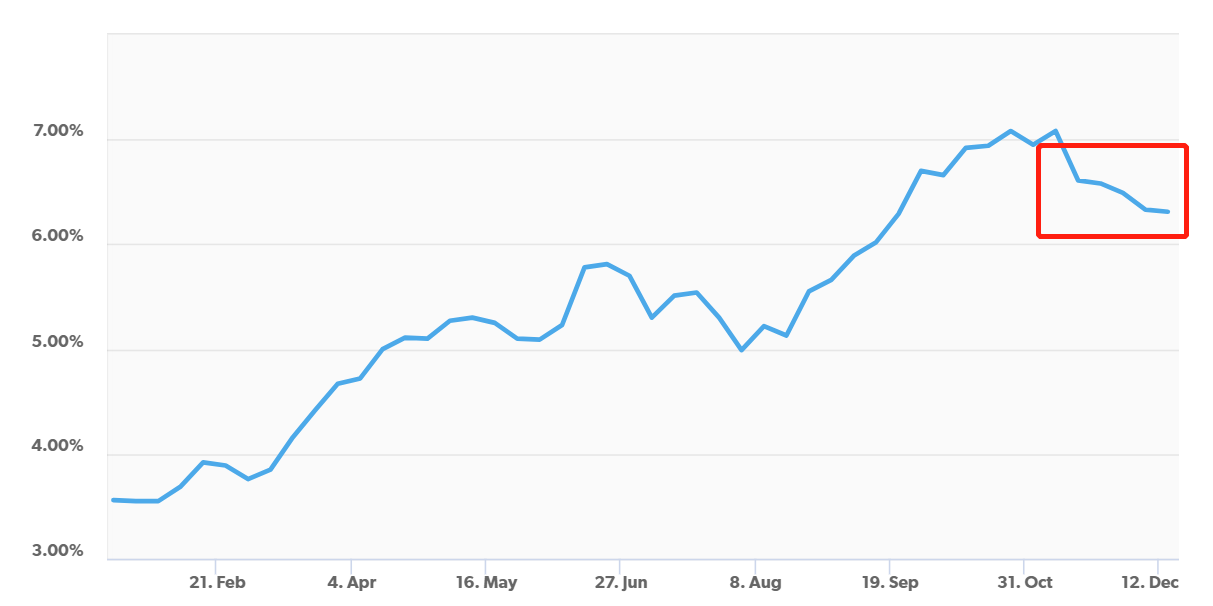

Image source: Carson

Historically, the Fed's tightening cycle has tended to stop when rates are raised above the CPI - the Fed is now getting closer to that goal.

When will it transition to rate cuts?

As for moving to rate cuts in 2023, the Fed has not made that plan clear.

Powell said, вАЬOnly when inflation falls further to 2% will we consider a rate cut.вАЭ

According to Powell, the most important factor in the current inflation storm is core services inflation.

These data are mainly influenced by the current strong labor market and persistently high wage growth, which is the main reason for the increase in service inflation.

Once the labor market cools and wage growth gradually approaches the inflation target, then headline inflation will also decline rapidly.

Will we see a recession next year?

In the latest quarterly economic forecast summary, Federal Reserve officials again raised their expectations for the unemployment rate in 2023 - the median unemployment rate is expected to rise to 4.6 percent next year from the current 3.7 percent.

Image source: the Federal Reserve

Historically, when unemployment rises like this, the U.S. economy falls into recession.

In addition, the Federal Reserve has lowered its forecast for economic growth in 2023.

The market believes this is a stronger recession signal, that the economy is at risk of falling into recession next year, and that the Federal Reserve may be forced to cut interest rates in 2023.

Summary

Overall, the Federal Reserve has reduced the pace of rate hikes for the first time, officially paving the way for slow rate increases; and the gradual decline in data from CPI reinforces expectations that inflation has peaked.

As inflation continues to weaken, the Fed will likely stop raising rates in the first quarter of next year; it may consider cutting rates in the fourth quarter due to growing recession concerns.

Photo credit: Freddie Mac

The mortgage rate has stabilized at a low point over the past three months, and it is difficult to see a significant increase again, and will likely gradually fall into shock.