Unpacking San Diego County's 17% Down Payment Assistance Program

Eligibility Criteria

- Applicants must be first-time homebuyers (those without property ownership in the last three years).

- Minimum credit score: 640.

- The property must be your primary residence.

- Complete a one-on-one consultation and a homebuyer education course. See the list of accredited training institutions: https://www.sdhc.org/wp-content/uploads/2022/Homebuyer-Education-Providers-List.pdf

- Besides the part subsidized, borrowers must make a minimum down payment of 3% (gift funds not permitted). The total down payment must not exceed 25% of the home purchase price; that is, if your initial payment exceeds 8%, the subsidy amount will be adjusted downward.

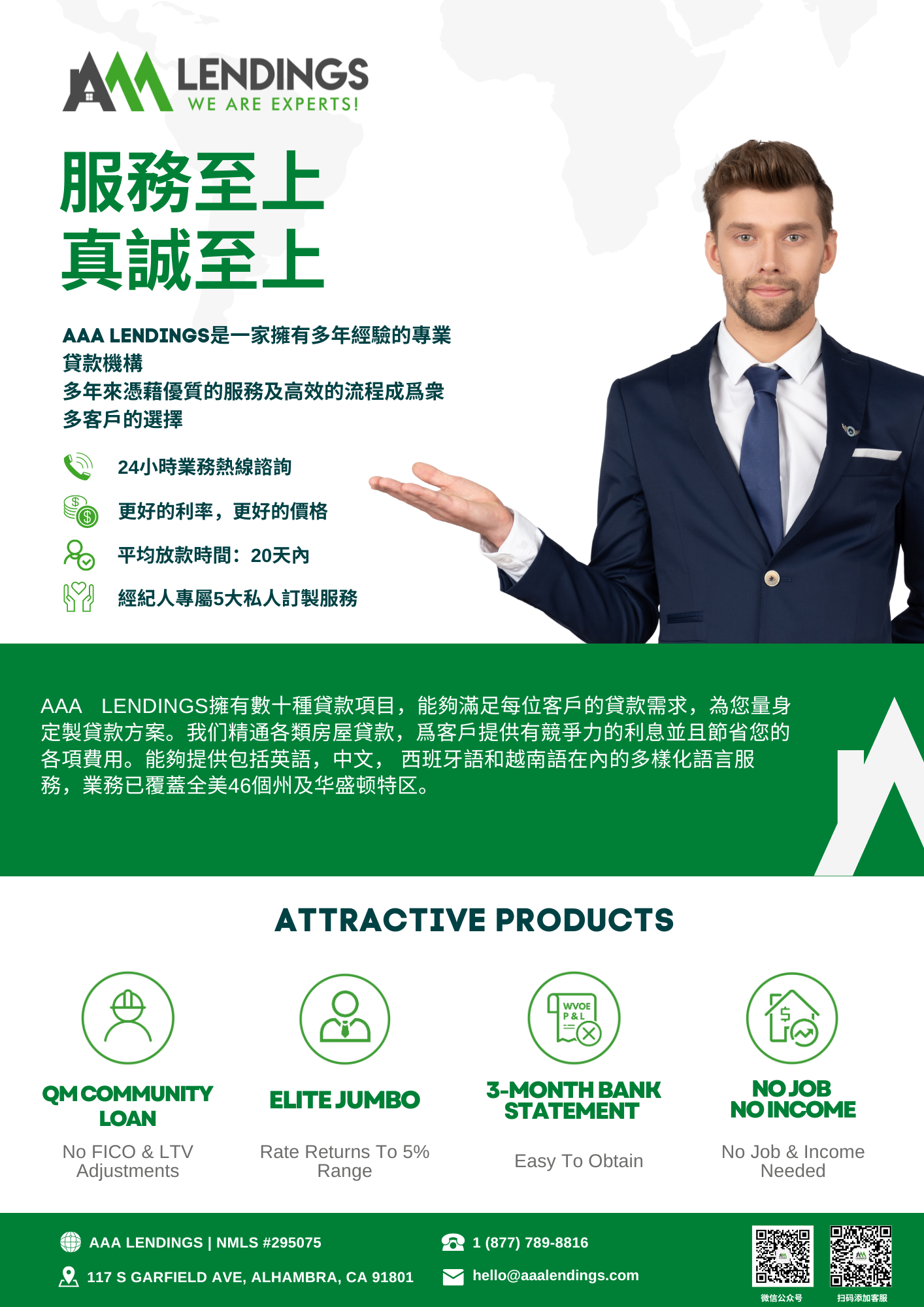

Income Guidelines

- The total income of the household must not surpass 120% of the median income in San Diego (AMI). Specific income constraints are outlined below:

For instance, a two-member family must have a total annual household income under $112,100 (income from all family members over 18 is considered).

Property Requirements

- Eligible property types: Single-family home, Townhome, Condo.

The maximum allowable purchase price is the median sales price published by C.A.R. each month. https://www.car.org/en/marketdata/data/countysalesactivity

Current maximum purchase prices: $935,000 for Single-family homes, $629,000 for Condos.

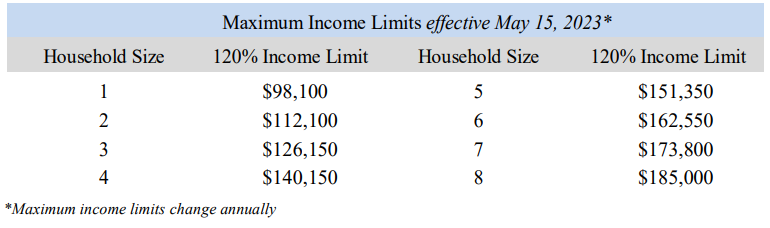

- The property must be located within San Diego County, including Coronado, Del Mar, Imperial Beach, Lemon Grove, Poway, Solana Beach and all unincorporated regions.

- The property must be unoccupied at the time of purchase, unless it's a tenant-purchase scenario.

Subsidy Details

- The maximum subsidy can be either 17% of the home's appraised value or 17% of the purchase price, whichever is less.

- The subsidy portion carries a 3% interest rate over a 30-year term, with no obligation to repay within those 30 years. You're only required to repay the subsidy along with accrued interest upon the sale, transfer, or rental of the property, or upon the loan's maturity.

- Refinancing is acceptable, but cash-out refinancing is not allowed.

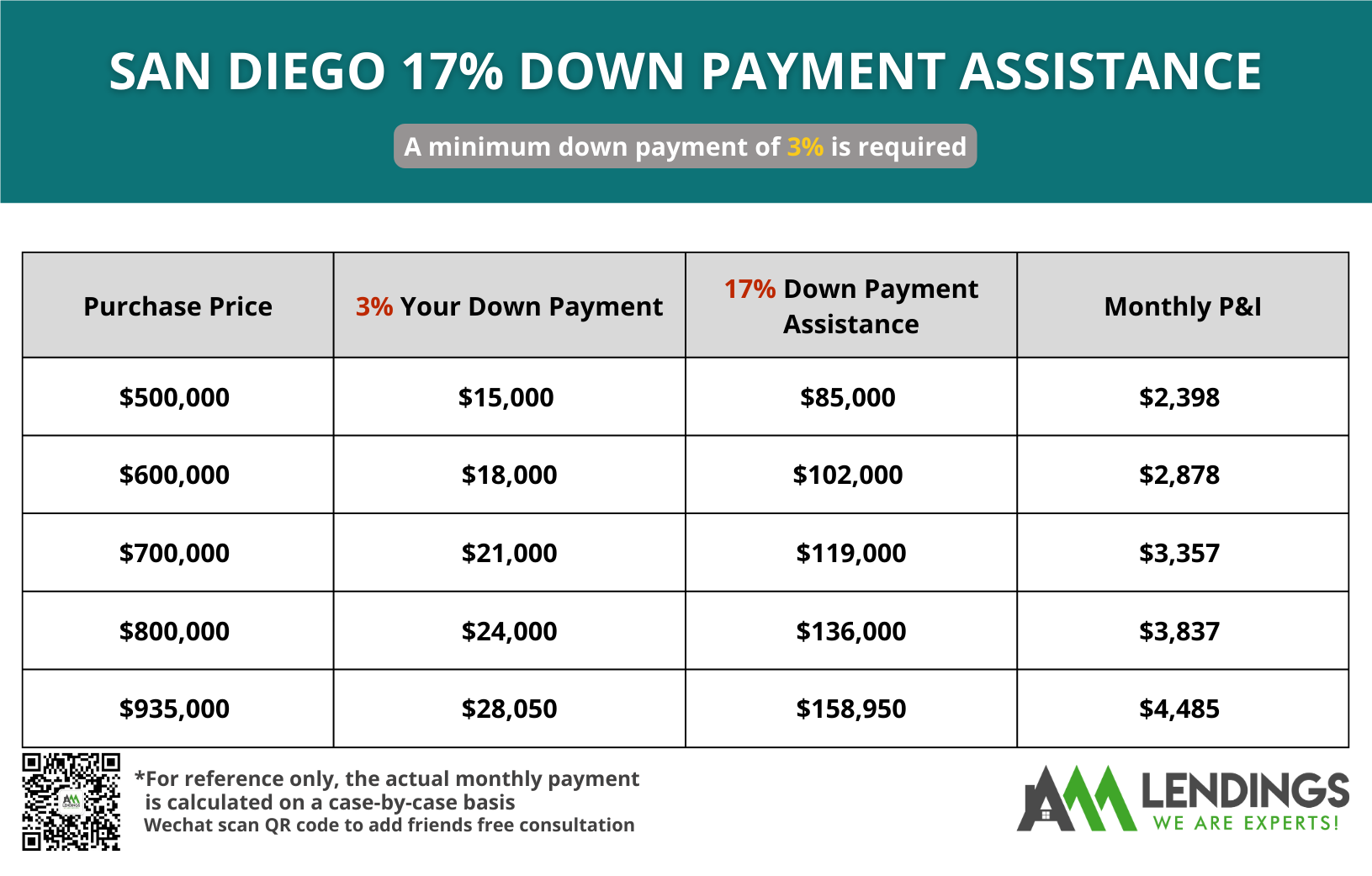

*Here are examples of potential purchase prices and corresponding monthly repayments, assuming a 17% subsidy and a 3% down payment:

Decoding San Diego City's $40,000 Subsidy

This $40,000 subsidy is aimed at the BIPOC community and comes with more generous income limits. Here's how it varies from the 17% subsidy program:

Eligibility Criteria

- Apart from the subsidy portion, borrowers need a minimum down payment of 1.5%.

- The upper limit for the purchase price of eligible homes is $1,250,000.

- The property must be situated within the city limits of San Diego. Applicable property types include single-family detached homes, condos, townhomes, or manufactured homes.

Income Guidelines

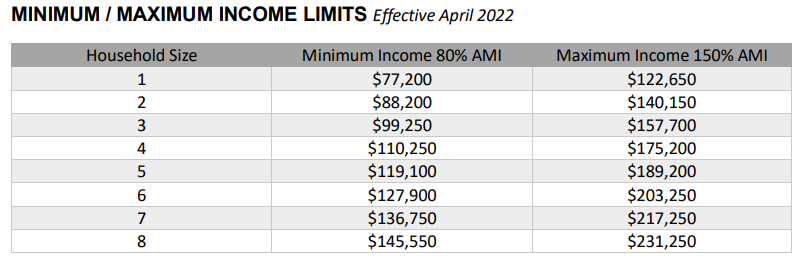

- Household income must be within 80%-150% of San Diego's median income (AMI). Specific income constraints are as follows:

Subsidy Details

- The maximum subsidy can reach $40,000, with up to $20,000 available for the down payment and another $20,000 for loan fees (the latter does not require repayment).

- The down payment subsidy portion has an interest rate of 1.5% over a 15-year term; there's no repayment obligation for the first seven years. Starting from the eighth year, both principal and interest on the subsidy portion are to be paid back monthly. There is no penalty for early repayment, offering you the flexibility to repay at any time.

- If you sell, rent out, transfer, or perform cash-out refinancing of the property within 15 years, the subsidy along with accrued interest needs to be repaid.

At present, both programs have ample funding. So, don't let this golden opportunity for assistance slip away if you meet the eligibility criteria. Get in touch with us at AAA LENDINGS today to get your application process started!"