Why are more and more people choosing Prime No Doc?

What challenges is the current U.S. mortgage market facing?

In July 2025, the U.S. mortgage market entered an "era of high costs":

Mortgage rates remain high: The 30-year fixed rate is stable at 6.75% - 6.95%, and the cost for borrowers continues to rise.

Difficulty in approval due to insufficient taxable income: Self-employed clients, overseas investors, and newly retired clients are often rejected for loans because of insufficient income proof or excessive DTI.

Soaring insurance costs and stricter loan approval: Especially in the condo market, "failure to approve" has become one of the main reasons for deal failures.

Traditional loans are too rigid: They require documents such as W2, 1040 tax returns, and employment certificates, which keep many clients who actually have the ability to buy a house out of the door.

Against this background, a loan product that does not check income, does not calculate DTI, and does not require proof of employment has become a market just need - Prime No Doc is born for this.

What is Prime No Doc?

Prime No Doc is a flagship asset-based loan product launched by AAA Lendings. It does not require the provision of income and employer information, does not look at the DTI ratio, and the entire review process is based on "assets covering debts". It is one of the truly "full asset evaluation loans" on the market.

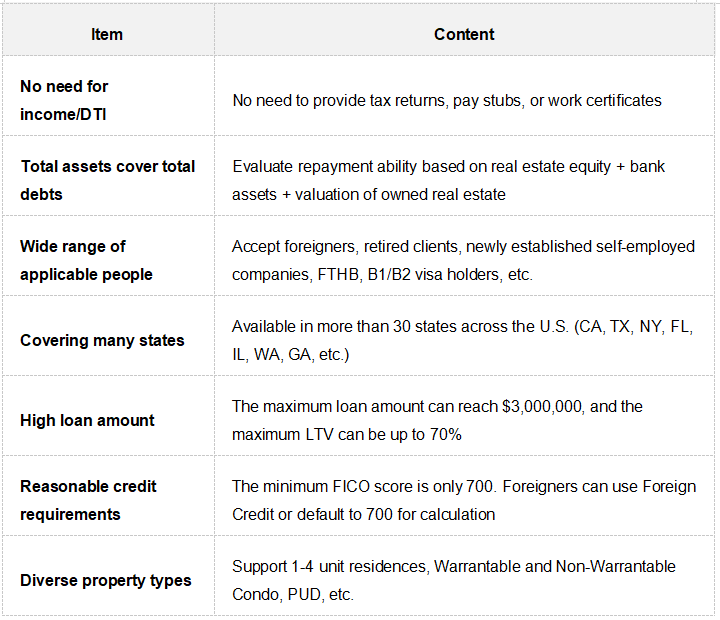

Core highlights of the product:

Who is Prime No Doc suitable for?

The following groups are especially recommended to consider using the Prime No Doc product:

Overseas clients & Foreign Nationals

- No U.S. tax filing records / No SSN / Hold B1/B2 visas

- Plan to buy a second residence in the U.S. for vacation or children's study abroad

- Can provide sufficient overseas or U.S. assets and use foreign credit records

Self-employed clients & those with insufficient tax returns

- The company has just been established and has no complete tax filing history

- Stable cash flow but severe tax avoidance, resulting in low income on tax returns

- Can use the company account (100% owner + CPA letter)

Asset-based borrowers

- High-net-worth retired clients with large securities, savings, and retirement accounts

- Want to buy a second home for retirement or long-term holding

- Income shown on tax returns is insufficient, but assets are stable

Those replacing a house / with excessively high DTI

- Selling the original residence but needing to buy a new house first

- Holding two houses at the same time resulting in high DTI

- Can use the valuation of the original property as an asset to calculate and cover debts

First-time homebuyers + Non-occupant Co-borrowers (FTHB + Non-Occupant Co-Borrower)

- Young homebuyers use their parents' assets + non-occupant co-signatures to meet the standards

- Accept Gift Fund (up to 4 donors)

Case brief analysis

Case 1: An overseas mother plans to buy a second residence for her children

Identity: Hong Kong resident, holding a B1/B2 visa

Assets: $800,000 in U.S. account + $200,000 in Hong Kong account (converted)

No tax filing records, no W2, no SSN

Successfully passed the Prime No Doc review and got a loan of $650,000 to buy a school district house in Los Angeles as a 2nd home

Case 2: A retired client with a high investment account

Age: 58, retired

Assets: 401K + $1.2M investment portfolio

Income on tax returns is only $12K

Through Prime No Doc, the securities assets covered the debt, and successfully got a loan of $800,000

Case 3: A newly established self-employed business owner

The company has been operating for 8 months and has no tax filing history

$500,000 in the company account

100% owner + CPA issued a certificate that the company's use of assets will not affect operations

Can be used for full qualification review, and got a loan of $700,000 to buy a house

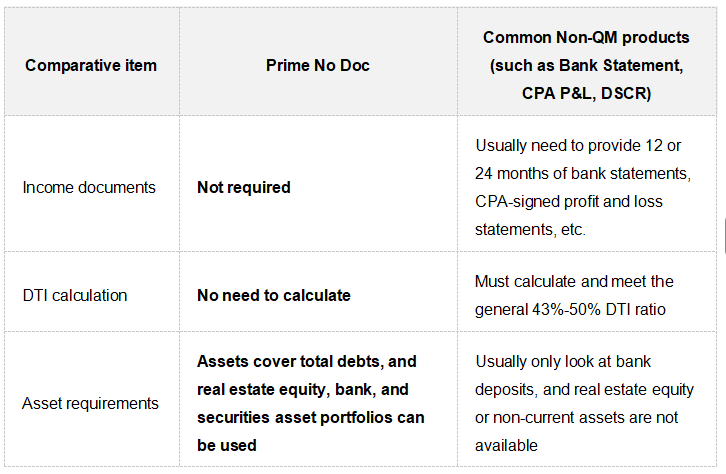

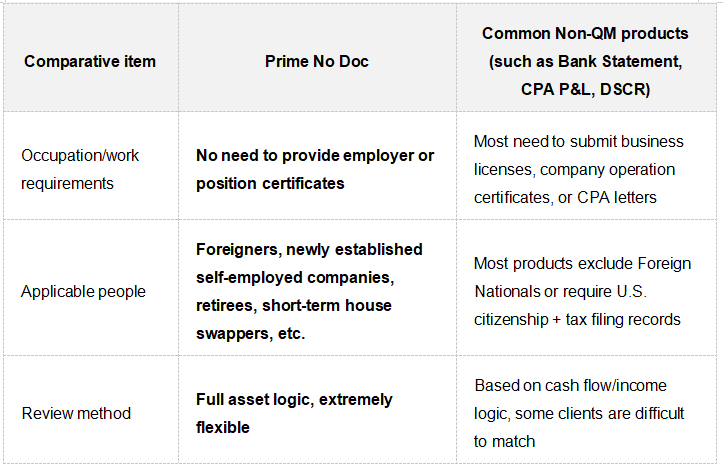

Comparative analysis of Prime No Doc and other Non-QM products

Compared with most Non-QM products on the market, the biggest highlight of Prime No Doc is that it "truly does not look at income and completely does not calculate DTI". Moreover, the review logic is transparent, the document requirements are simple, and it accepts a wide range of identities. It is really a sharp tool to solve the financing problems of self-employed, overseas, and high-net-worth clients.

| Conclusion: In the era of high interest rates, we should choose a more flexible loan method!

In the current context where U.S. mortgage rates are still high, compliance reviews are stricter, and many high-quality clients are unable to meet the "traditional loan standards", Prime No Doc is a bridge connecting real capabilities and financial opportunities.

If you or your clients meet any of the following conditions:

- Have no tax filing records but have assets

- It is inconvenient to provide work and income certificates

- Are foreigners / new immigrants / self-employed people

- Want to quickly complete loan transactions instead of waiting for a long approval process

Then, Prime No Doc is a choice worth considering.